The economic damage of the pandemic is far from over, but some sectors are showing the leading indicators of their future recovery. Airlines are reporting a surge in bookings for summer 2021, and major live sporting events are likely to start admitting some fans from early summer.

Global savings rates are at levels not seen for decades, a sign of the pent-up consumer spending that should drive strong demand for cars, clothes, holidays, sport and leisure.

Booming demand will attract fresh investment and strengthen battered balance sheets. While many of the current Covid winners will continue to benefit from permanently altered business and consumer habits, the losers who have survived so far could have a bumper year.

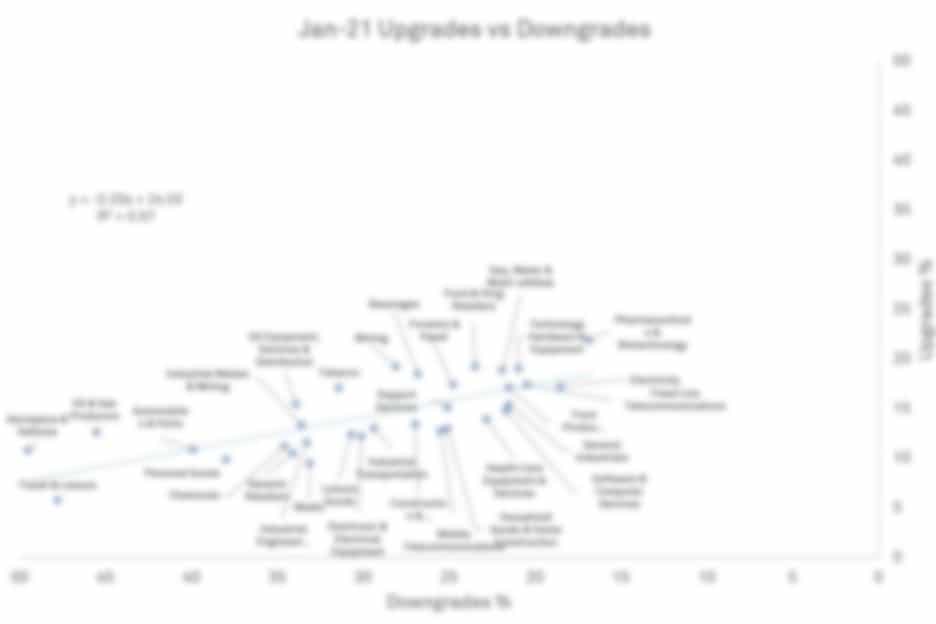

Figure 1 shows the pattern of 12-month consensus credit changes – upgrades and downgrades on the 21-category scale – for global sectors [please continue below to access full report].

Credit Benchmark data is now available on Bloomberg – high level credit assessments on the single name constituents of the sectors mentioned in this report can be accessed on CRPR or via CRDT . Get in touch with us to request your free trial for Credit Benchmark Premium Data and Analytics on Bloomberg.