Securities Finance and Prime Brokerage

Credit Consensus Data for Securities Finance and Prime Brokerage

Why Credit Benchmark?

Access more inventory, optimize capital allocation, and improve overall organizational efficiency

The sheer volume of beneficial owners and borrowers involved in securities finance transactions creates logistical issues and data bottlenecks that can impact business.

Credit Benchmark data provides transparency into the securities lending market and its participants, benefiting beneficial owners, lending agents, tri-party providers, principal borrowers, and technology data providers.

Solutions

How we can help your business

Understanding the optimal industry and rating can help benchmark portfolio-wide RWA optimization to drive the most capital-efficient business. The ability to understand what others think can help inform and support decisions to revise classifications that are detrimental.

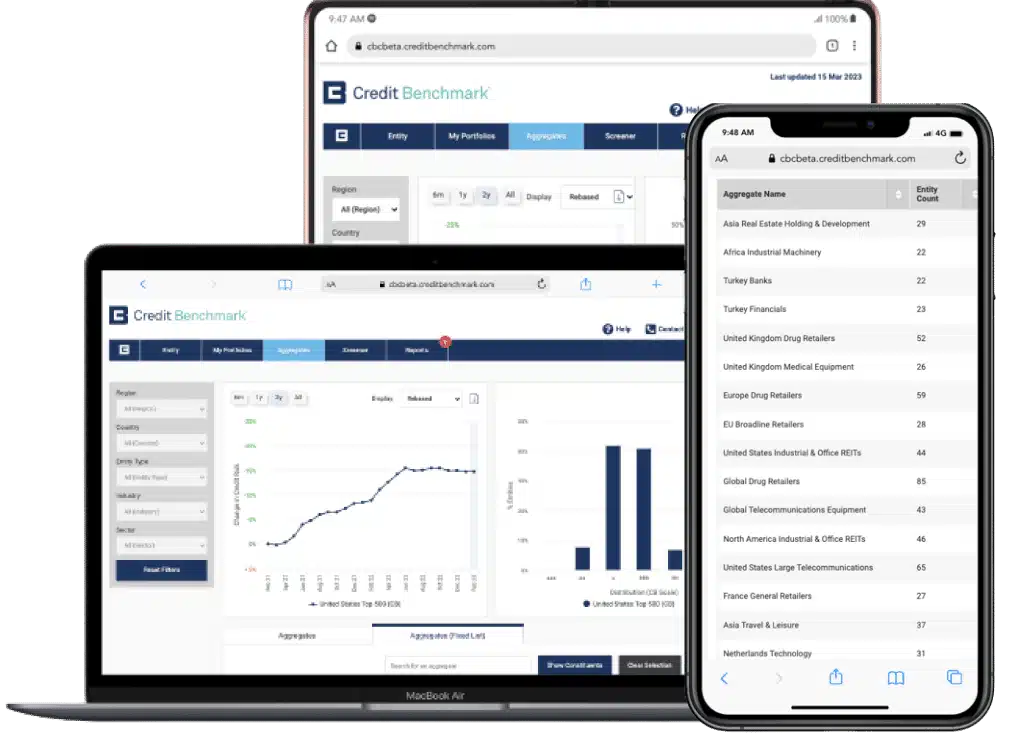

Access to Credit Consensus Ratings on 110,000+ legal entities, including banks, subsidiaries, CCPs, members, asset managers, and their underlying funds, helps clients measure, manage, and monitor counterparty risk on all sides more quickly. Alerting and monitoring capabilities track any portfolio credit risk movements.

Getting permission to do business with unfamiliar or unrated counterparts is a significant challenge for any business and an obstacle for peer-to-peer flow. Credit Benchmark facilitates and speeds up approval of new types of counterparts.

Consensus data seamlessly integrates into agent reporting systems, providing borrower and beneficial owner information. This data helps fill the data gaps and speeds up counterparty trading approvals.

Credit Benchmark’s coverage of 38,000 funds can help improve the understanding and decision-making process by providing transparency and the ability to focus, prioritize and optimize management of capital and RWAs to do more business.

Credit Benchmark data expands collateral eligibility by combining entity-level ratings with open-source notching to the security level, offering benefits across the market and to its participants.

Case Study

The Client

A major US-based agent bank and asset manager.

The Challenge

Many of the client’s beneficial owner and borrower names were publicly unrated, making it challenging to onboard and do business quickly. Capital constraints and regulatory imperatives made it difficult to do more standard business.

The Solution

Credit Benchmark allowed the agency lending program to see the borrowers that they are facing off against. The data was presented in reporting both internally and externally to their beneficial owner clients. The front-line credit team was able to approve and review fund counterparts more efficiently, facilitating more business. Benchmarking industry classifications and counterparty ratings helped the organization reduce RWA and optimize capital.

In Numbers

Entities with Credit Consensus Ratings

Bond and Loan Rating Assessments, Representing $34+ Trillion Outstanding

Risk Observations Feeding Into Twice-Monthly Data Updates

Credit Risk Observations Collected Since Launch in 2015

Industry & Sector Indices

Countries Covered

Major Global Banks Contributing, Almost Half Are GSIBs

Credit Analysts Contributing Risk Views

Of Universe Unrated by Traditional Rating Agencies

Of Corporate Universe Are Private Companies

The Benefits of Consensus Credit Data

Rating the unrated

Unparalleled coverage of public and private issuers; filling the gaps left by traditional ratings agencies.

Independent

Free from “issuer-pays” conflict and any bank bias.

Real-world exposure

Driven by the credit views of >40 of the world’s largest regulated banks, almost half of which are GSIBs.

Identify that entity

Risk data is processed through a sophisticated purpose-built mapping engine.

Dynamic

The consensus is refreshed twice monthly to provide dynamic indicators of potential credit risk changes.

Alerting and monitoring

Assess risk over the lifetime of a transaction.

Secure reporting

Ease of internal integration within reporting.

Expanding footprint

A unique growing global dataset.