Credit Benchmark is a financial data and analytics company that brings together internal credit risk views from 40+ of the world’s leading financial institutions.

What we do

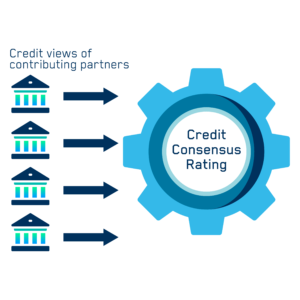

Credit Benchmark provides Credit Consensus Ratings and Analytics calculated based on contributed risk views from 40+ leading global financial institutions, almost half of which are GSIBs. These institutions are domiciled in the US, Continental Europe, Switzerland, the UK, Japan, Canada, Australia, and South Africa. The contributions are anonymized, aggregated, and published weekly in the form of Credit Consensus Ratings and Credit Indices.

Why consensus credit risk data

Credit Benchmark meets a long-standing need for an alternative or complement to the two traditional credit risk content providers: issuer-paid rating agencies and third-party model vendors.

For regulatory and business reasons, banks have each created their own regulated internal credit rating agency to assess the creditworthiness of tens of thousands of obligors. By collecting, aggregating, and anonymizing this information, Credit Benchmark provides an independent, real-world measure of risk on rated and unrated entities globally, delivered fortnightly to our partners.

The first of its kind, “credit consensus” provides a new, different view of credit risk that is neither an agency rating nor a model output, offering coverage, depth, and collective insight available nowhere else. The credit consensus outputs reflect the expertise of more than 20,000 credit analysts across our contributing partners – a powerful example of the wisdom of crowds.

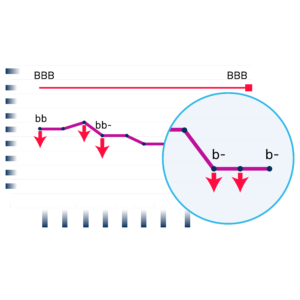

Better Aligned

Unique insight into how financial institutions are assessing the credit risk they are exposed to, in contrast to legacy issuer-paid model

The Power of Consensus

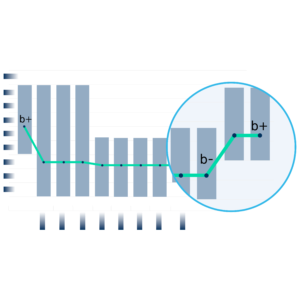

Multiple contributions to the consensus minimize chances of missing credit risk changes

More Frequent

Weekly updates provide dynamic indicators into underlying deterioration or improvement in credit quality

More Coverage

Coverage of 110,000 public and private entities, the vast majority publicly unrated

Industry Awards & Recognition

Experienced Leadership

Credit Benchmark was founded in 2013 by two experienced entrepreneurs, Mark Faulkner and Donal Smith, who had previously worked together on Data Explorers, founded by Mark in 2002 and now part of IHS Markit.

Expert Investment

The company is backed by leading venture capital firms Index Ventures and Balderton Capital.

Strong Governance

Credit Benchmark’s Advisory Board, chaired by Craig Broderick (former Chief Risk Officer of Goldman Sachs) provides guidance on Credit Benchmark’s strategy and market positioning. Robust internal compliance and policy standards are adhered to to ensure the quality and relevance of the data output.

WHAT OTHERS ARE SAYING

Testimonials

"Credit Benchmark enables us to say yes faster and potentially get bigger deals approved. With an independent benchmark validating our internal ratings, we make quicker, more confident decisions at all levels."

"We gain the perspective of multiple analysts in one consensus rating. Credit Benchmark expands our visibility into private and unrated names, improving our models and risk insight."

“Credit Benchmark gives us the confidence to expand our risk appetite, approve larger underwriting deals, and raise ratings where justified — helping us win more business and grow faster, without compromising risk standards.”

“Credit Benchmark provides the early warning signals we need to stay ahead of emerging risks. It sharpens our focus, highlights exposures that need action, and enables more proactive portfolio management — strengthening our overall risk oversight.”

"Credit Benchmark strengthens our counterparty risk management and internal reporting. External validation increases regulatory confidence and trust in our credit models."

"Credit Benchmark lets us monitor more counterparties with greater confidence and no extra headcount – allowing us to streamline credit assessments and focus our resources."

Data that works for you

Credit Benchmark data is available via our Web App, Excel add-in, API, flat-file download, and third-party channels including Bloomberg, Snowflake, and AWS.

Contact us to request a full service demo and learn how Credit Benchmark helps risk professionals manage their capital and risk more effectively and efficiently.