Specialty Credit and Political Risk Insurance and Reinsurance

Credit Consensus Data for Specialty Credit and Political Risk Insurance and Reinsurance

Why Credit Benchmark?

Underwrite more business, more confidently

Relying on traditional credit risk data presents challenges: much of the insurance market is private or unrated, and available credit information can become stale quickly. Time-consuming analysis leads to inefficiencies when screening for new business.

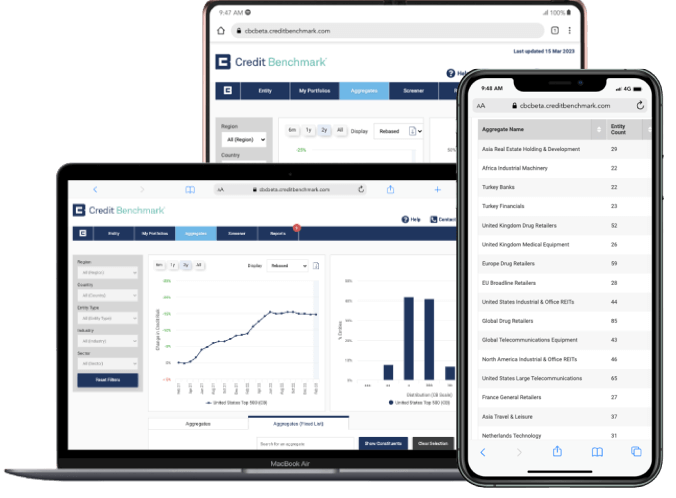

Using credit consensus data, direct insurers can see what leading global financial institutions think of obligors, uncovering more compelling underwriting opportunities with fewer resources. Reinsurers can map, measure and monitor their portfolio more effectively.

Solutions

How we can help your business

Confidently underwrite more opportunities within your target geographies, sectors and credit risk tolerance

Sift out which opportunities justify the attention of precious analyst resources especially in the more opaque private or unrated space.

Build portfolio resilience and fine-tune underwriting strategy by monitoring the portfolio by individual names, sectors and geographies with consensus credit risk data and analytics.

Facilitate more meaningful and frequent management reporting, especially under quickly changing market conditions.

Make better sense of the legal entities in a book of business with coverage of parent and subsidiary-level entities and using Credit Benchmark’s sophisticated mapping engine.

Help CPR actuaries finesse pricing models with unique consensus LGD data and sector credit risk correlations produced from the expertise of global banks.

Case Study

The Client

A leading CPR business within the Lloyd’s of London specialty market arm of a top three US P&C insurance group.

The Challenge

The underwriters and credit analysts at this insurer found that traditional agency rating coverage of their names of interest fell short, and they lacked confidence in the quality and provenance of the data available to them. The actuaries were spending too much time on entity mapping and using external data references that were refreshed infrequently.

The Solution

Credit Benchmark’s extensive consensus coverage on unrated and private names increased the client’s underwriting activity by enhancing the decision-making process, while the provenance of the data provided increased peace of mind. Twice-monthly updates informed underwriting strategy and enabled increased management reporting, and the team benefited from Credit Benchmark doing the heavy lifting of entity mapping, allowing them to do business more efficiently.

In Numbers

Entities with Credit Consensus Ratings

Bond and Loan Rating Assessments, Representing $34+ Trillion Outstanding

Risk Observations Feeding Into Twice-Monthly Data Updates

Credit Risk Observations Collected Since Launch in 2015

Industry & Sector Indices

Countries Covered

Major Global Banks Contributing, Almost Half Are GSIBs

Credit Analysts Contributing Risk Views

Of Universe Unrated by Traditional Rating Agencies

Of Corporate Universe Are Private Companies

The Benefits of Consensus Credit Data

Rating the unrated

Unparalleled coverage of public and private issuers; filling the gaps left by traditional ratings agencies.

Independent

Free from “issuer-pays” conflict and any bank bias.

Real-world exposure

Driven by the credit views of >40 of the world’s largest regulated banks, almost half of which are GSIBs.

Identify that entity

Risk data is processed through a sophisticated purpose-built mapping engine.

Dynamic

The consensus is refreshed twice monthly to provide dynamic indicators of potential credit risk changes.

Alerting and monitoring

Assess risk over the lifetime of a transaction.

Secure reporting

Ease of internal integration within reporting.

Expanding footprint

A unique growing global dataset.