The Apollo 13 moon rocket explosion in 1970 caused immediate failures in multiple systems. Primitive computers poured out reams of data, all with the same message: the moon landing had to be immediately abandoned, and the astronauts were now in mortal danger.

At risk of information overload, the exasperated flight controller asked, “what have we got on the spacecraft that’s good?”[1]

The climate crisis is at that point – spaceship earth losing its life support system, with limited time, resources and brainpower to guarantee human survival. Published ahead of COP27, the latest UN study is a stark warning that despite lots of talk, there is as yet no agreed feasible solution:

COP26 looked like a wasted opportunity; so COP27 needs to answer one question: Is a declining standard of living the price of a sustainable future? A basic consumer society, limited foreign travel, only essential powered gadgets; appealing to some, a nightmare to many.

In theory, technologies like carbon capture or nuclear fusion will solve the problem, but they need years of R&D, huge investment, and major re-engineering of the global economy. And while R&D works on the problem, how do we handle the immediate crisis?

For reasons of geography or history, many developing countries are on the extreme weather frontline. Lacking resources, they depend heavily on domestic food production at risk from droughts and floods; they also lack the funds to mitigate the impact of climate change.

Early COP27 discussions have flagged the issue of “reparations” (i.e. losses and damages) – controversial proposed payments from energy intensive developed economies to more vulnerable, low consumption, less-developed. The UN estimate developing country mitigation and adaption costs at $200bn pa currently (and $600bn pa by 2050). Major economies have agreed to fund half of that – but are struggling to do so; in part because meaningful net zero progress requires huge investment by major economies.

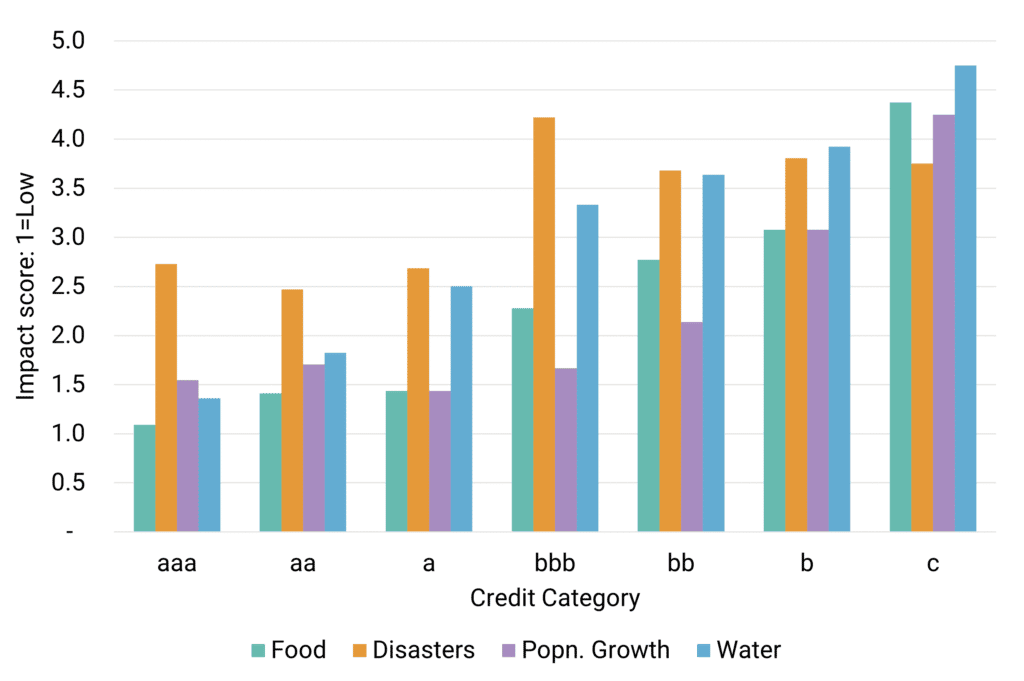

Climate risk assessments are plentiful, but different methodologies lead to some very different conclusions. The CRI reports on actual climate impacts by country each year, plus a cumulative index for the period 2000-2019. The CEI looks at likely economic damage, for a sample of 48 economies. The Institute for Economics and Peace provide publishes future impact assessments on a 1 to 5 scale, for nearly every country in the world, split into Food Security, Water Issues, Climate Disasters, and Population Growth. Figure 1 shows averages for these, split by 7-category Credit Consensus Ratings, for 118 Sovereign Governments.

Figure 1: Average Impact Scores by Credit Category

As discussed, countries with weaker credit ratings will typically see more impact, especially on Food and Water metrics. Population growth impact is less correlated with credit risk, except in the b and c categories. But the surprise in this chart is the impact of Disaster-related mortality – highest in the bbb category, and even the aaa category is significant.

This fits with recent experience, which shows that developed economies are also seeing rapid climate change: record floods in Germany, wildfires in Portugal, Spain and France; Alpine glaciers disappearing, reducing reliable meltwater yields for agriculture; increased variation in temperatures and rainfall confusing plants and hitting harvests; mosquito-borne dengue fever a growing problem in Southern Europe. These indicate future food and water problems, so Figure 1 is likely to flatten over time with all credit categories showing steady increases in each impact category.

Some Non-Investment Grade countries are currently in the low impact category – mainly in the Balkans, the Arabian peninsula, or Central Asia. And some Investment Grade countries are in the high impact category – including Mauritius, Panama, Botswana, Malaysia and the Philippines.

One end of the impact distribution is heavily skewed to Sub-Saharan Africa – Burundi, CAF, Kenya, both Congos, Niger, South Sudan; while the other is mainly countries in North West Europe. If these two groups cannot agree on a “losses and damages” framework, there is little point in pursuing it more broadly.

The Economist states three blunt climate crisis truths:

Credit Consensus data includes ratings for countries that do not have full agency coverage, and the consensus universe continues to grow. These risk assessments are made by banks with a major stake in the outcome, banks experienced in lending to frontier economies. For this reason, Credit Consensus Ratings may have a key role to play in a Brady-bond style framework.

[1] According to the Ron Howard movie. Gene Kranz does not seem to have actually said “Failure is not an option.” But everyone at NASA was thinking it…