COP26 has got off to a shaky start with the premiers of China, Russia, Brazil and Turkey not attending. The G20 meeting in Rome reached agreement on a minimum corporate tax rate, but in the run up to COP26, host Boris Johnson worried that unity on climate action would be too much of a stretch.

There have been some good headlines: a pledge to end deforestation by 2030, a promise to start paying the $100bn already pledged by developed countries, and declarations of net zero targets from various countries by various dates over the next 50 years. But the real debate is about the need for speed in translating pledges into action.

It is probably easier to agree on taxing multinationals than on sharing the climate burden. It is developing countries that are suffering the most, in part because many of them already inhabit the economically marginal parts of the world where changes in weather systems are first felt. Climate change is likely to amplify those effects and increase the disparity with developed economies.

So countries that are most in need of help are least able to help themselves, while some of the largest economies may be major contributors to the problem but may also be best placed, economically, to fix it. Climate change solutions need major investment; Swiss Re estimate that without it, the cumulative effect of crop failures, floods, and heat stress is expected to cost at least 10% of global GDP by 2050.

This sobering forecast was published earlier this year as part of a detailed assessment of the economic impact of climate change on 48 countries, covering 90% of global GDP. Countries are assessed on the GDP impact of factors such as crop failures, heat stress and sea level changes set against their capacity to adapt1 to these. Top of the Climate Economics Index (“CEI”) are Finland, Switzerland, Austria, Portugal and Canada. At the bottom are Indonesia, Malaysia, Philippines, India and Thailand.

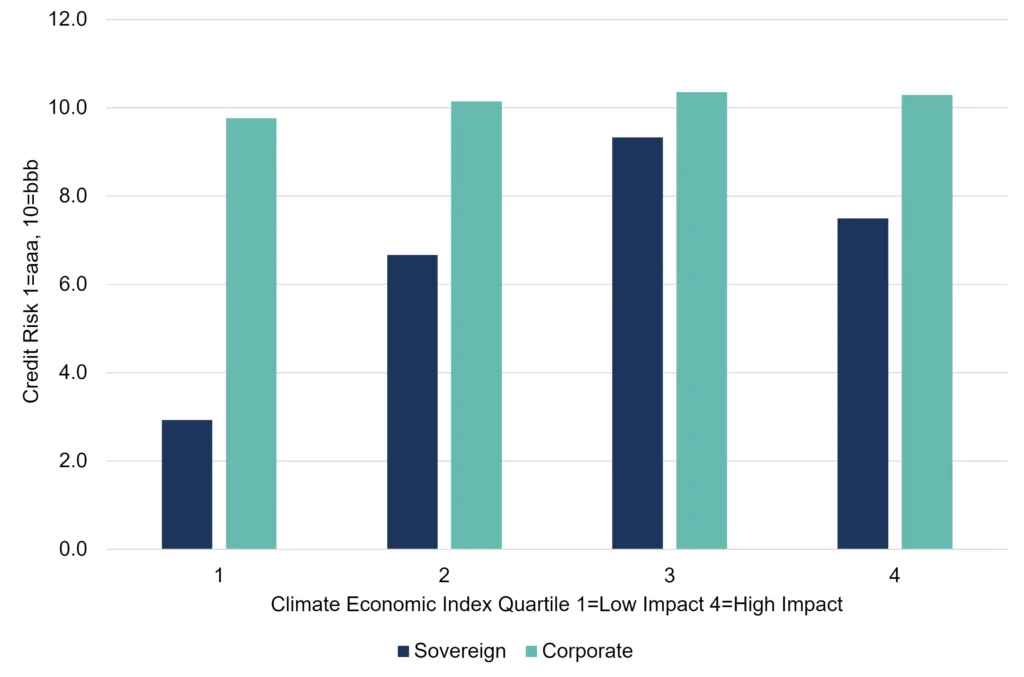

Figure 1 shows the average consensus credit risk (in 21 categories) of the 48 countries split into CEI quartiles. The values for Sovereign (i.e. Government) and Corporate risk are shown separately.

For Sovereign credit risk, there is a clear difference of about 5 notches between the Low and High impact countries, but the highest credit risk is in the third quartile. Corporates, on the other hand, show very little difference – suggesting that firms that are in a position to borrow from the largest banks in the world are also able to weather the impact of climate change – by relying on support from a parent in the developed economies, or by relocating.

Most of the countries that are most at risk from climate change are not significant contributors to the problem – they can only address the symptoms, not the underlying causes. As Figure 1 shows, these countries tend to be higher credit risks, making it more expensive for them to act, even if that action is limited to mitigating the damage. This disparity is at the heart of the COP26 debate.

In conclusion, consensus credit data reinforces the argument that any solution to tackling climate change is largely in the hands of developed economies. Their governments have stronger consensus ratings, while multinationals have a vested interest in protecting their subsidiaries across the developing world.

Credit Benchmark data is now available on Bloomberg – high level credit assessments on the single name constituents of the sectors mentioned in this report can be accessed on CRPR or via CRDT . Get in touch with us to request your free trial for Credit Benchmark Premium Data and Analytics on Bloomberg or via our Web App.

Please complete your details to download this report:

1Based on the Verisk Maplecroft Climate Change Adaptive Capacity Index.