The Covid19 crisis has exposed the risks in single, long and complex supply chains that are only as strong as their weakest link. Companies are moving quickly to multiple, short, simple and robust supply structures wherever possible.

Some companies view their supply chain details as trade secrets, but a number of financial data platforms – such as Bloomberg and Factset – provide detailed information on suppliers and customers for many of the largest firms in the world.

This data can be combined with consensus credit data to construct supply chain credit profiles for individual companies and even for entire sectors.

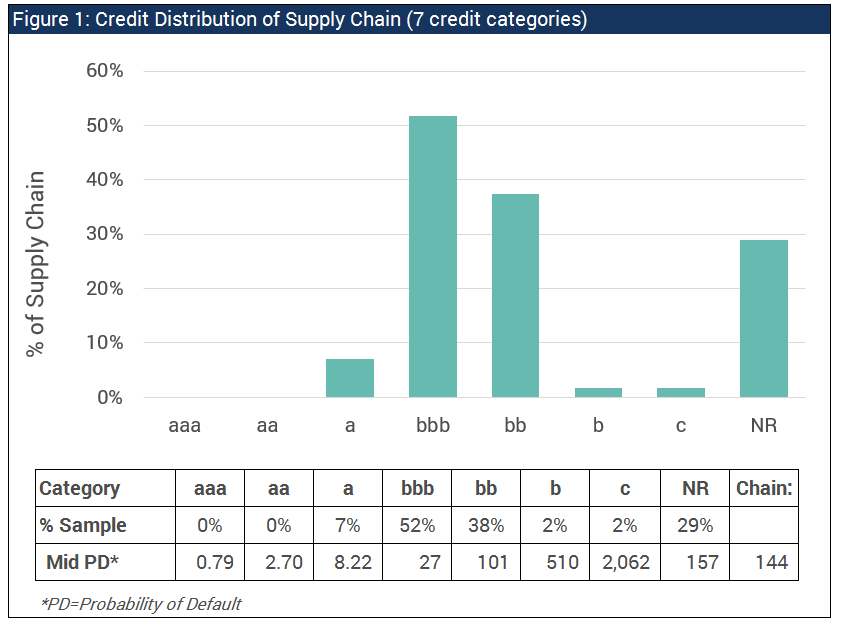

The extended report showing the full credit profile for a sample of 79 Tesla suppliers can be downloaded at the bottom of the page. Below is an extract showing the credit distribution of the 79 suppliers.

As Figure 1 shows, the majority of the sample are in the bbb category, but about a third are in the sub-Investment Grade bb category. A further 30% have no consensus ratings, probably because they are small and specialised suppliers. There are very few suppliers in the b and c categories. The overall weighted average Probability of Default over one year is 144 Bps, or about 1.4%.

These suppliers are spread across a range of sectors and recent trends for these are shown in Figure 2 (see full downloadable report below). Not surprisingly, all of these show sharp deterioration and a string of consecutive net downgrades. On average, these sectors have deteriorated by about 6% over the past three months. Of these, software and services has only deteriorated by 1%; the worst hit is Oil & Gas, down 13%.

Supply chain risk monitoring and management is becoming a high profile topic; consensus credit data has a key role to play in that process.