Following the March J.D. Power and LMC Automotive Forecast showing the slowest Q1 for U.S. auto sales since 2013, the industry hopes to see recovery in sales volumes in the coming months.

According to a recent report from global research institute TrendForce, car manufacturers are hoping to see growth in the electric vehicle market. Electric vehicle shipments are predicted to hit 5.15 million this year, reaching a YoY growth of 28%.

And although auto companies face mounting pressure from the Trump administration to manufacture in America, they are pushing forward with plans to use China as an export hub, particularly for electric cars.

With the pivot toward hybrid and electric vehicles underway and expectation that the U.S. Federal Reserve will keep rates stable in 2019, the deferral of purchases in Q1 could lead to a surge in auto demand in Q2 and beyond.

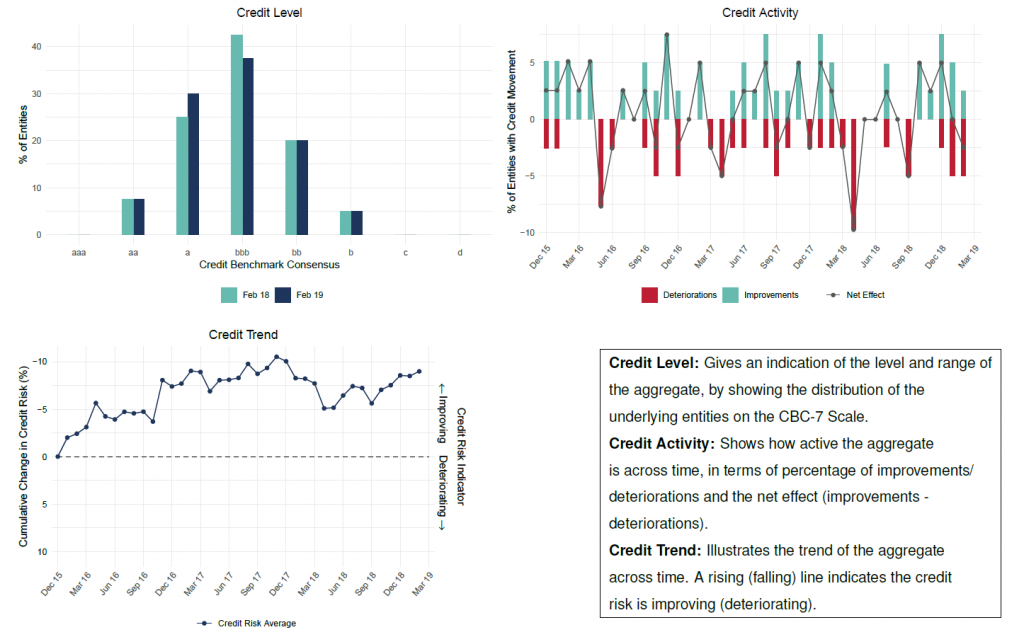

This possibility is reflected in the Global Car Manufacturers aggregate credit data from Credit Benchmark below.

Credit Benchmark’s credit risk data, sourced from 30+ of the world’s leading financial institutions, shows that global auto manufacturer credit continues to improve modestly.

Chart 1 (Credit Level) highlights the Credit Benchmark consensus designation for Global Auto Manufactures year-to-year. Most borrowers are in the bbb categories, with the number of entities rated bbb decreasing by 5% from Feb 18 – Feb 19.

Chart 2 (Credit Activity) shows that upgrades outnumber downgrades in 21 of the previous 39 months. This positive trend has balanced over the last year with 4 of the last 12 months showing a net upgrade and 4 showing a net downgrade.

Chart 3 (Credit Trend) shows that after waves of upgrades in some months followed by waves of downgrades in others, the credit risk average of Global Auto Manufacturers began to indicate a modest improvement from November 2018, which is continuing.