Credit risk has never been more important. But while credit has always been the main driver of corporate bond risk, equity managers have traditionally focused on earnings growth and share price volatility. The Covid crisis has turned this on its head; earnings still matter, but only if a company can survive long enough to renew its revenue growth in the new normal business environment.

Equity markets have experienced near-record levels of volatility in the past few months and there have been some savage individual share price drops. Markets are adjusting to the prospect of a 1930s Depression-like contraction in GDP and a short-term collapse in earnings, but are they also discounting the looming rise in corporate defaults?

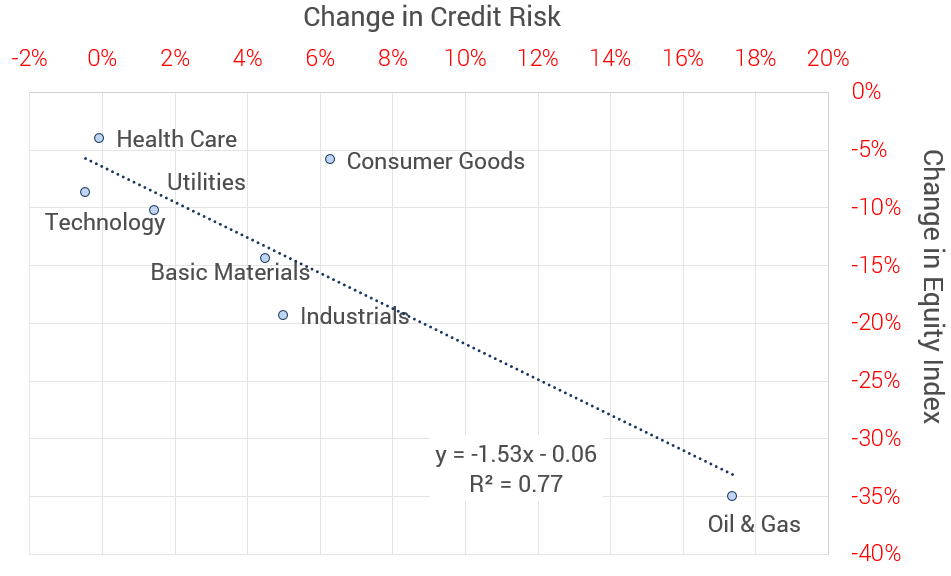

Consensus credit assessments certainly showed major changes in March, and further revisions are expected in Q2. The relationship between the March movements and US equity market industry performance for the same period is shown in the below chart.

There is a noticeable negative correlation between this small group of industry credit risk changes and the associated US equity performance over this period. The overall fit is 77% and the slope of the fitted line is 1.53. This implies that after allowing for a base level of equity market drop (the intercept of 6%), each 1% increase in one-year consensus credit risk is associated with a 1.5% decrease in equity values.

The worst affected industry is Oil & Gas, with a 35% decline in equity value and an 18% increase in credit risk. The least affected is Health Care with a 5% decline in equity value and no change in credit risk.

The Consumer Goods industry is an obvious outlier. Credit risk has increased 6%, while the industry index has only declined 5%. It is possible that the credit consensus was previously too optimistic – or it may now be too pessimistic. It is equally possible that the equity market is not taking sufficient notice of deteriorating balance sheets in the industry. Perhaps a wave of mergers and acquisitions will rescue a number of otherwise heavily indebted companies. The next few months will tell.

This chart suggests that the link between credit risk and equity markets may be significant, especially in the current environment.