COVID has led to waves of downgrades across many sectors, with an unprecedented number of Fallen Angels[1]. While there have also been some clear COVID winners, Rising Stars[2] have so far been in a minority. But with vaccines now being rolled out, an end to the economic crisis could be in sight even for some of the hardest-hit sectors.

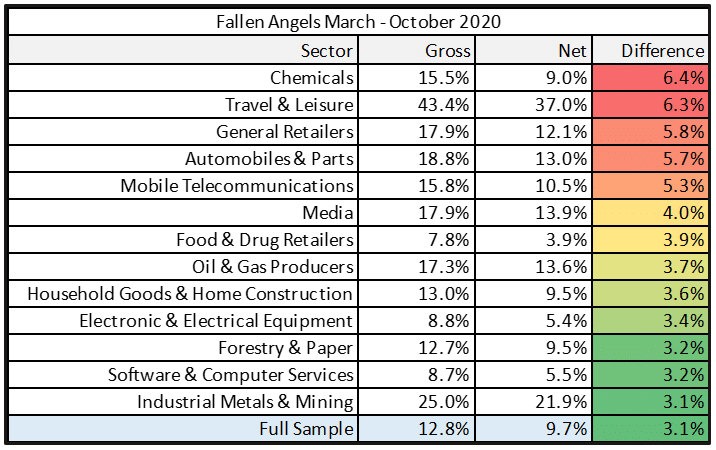

Table 1 shows the latest data for gross and net cumulative Fallen Angels for a number of global sectors. The gross cumulative total of Fallen Angels is not adjusted for those firms that then migrate back to investment grade; the net column makes that adjustment. The table is sorted by the size of the gap between the gross and net figures. Only sectors with above average differences are shown.

Table 1: Fallen Angels March – October 2020

Chemicals and Travel & Leisure stand out as the sectors with the highest difference between gross and net. This suggests that a relatively high number of companies in these sectors were prematurely downgraded and have subsequently recovered. This may partly reflect Government support; it may also indicate that some of the economic effects of COVID were more complex and subtle than they initially appeared.

These two sectors are closely followed by General Retailers, Autos & Parts, and Mobile Telecomms. Media, Food & Drug Retailers, and even Oil & Gas Producers show a significant proportion of Fallen Angels that have rapidly recovered.

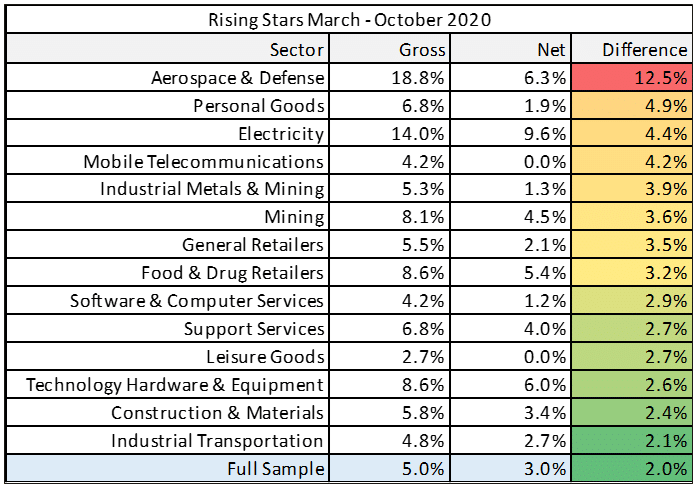

Table 2 uses the same approach for Rising Stars.

Table 2: Rising Stars March – October 2020

The largest difference – 12.5% – is in Aerospace & Defence, but the sample is small. Personal Goods, Electricity, and Mobile Telecomms (also a small sample) are the next three highest. Industrial Metals and Mining, Food & Drug Retailers and Software & Computer Services all appear on both lists.

Sectors which are present on both lists show a mix of COVID winners and losers. For example, speciality food retailers have suffered from the lack of footfall; drug retailers have seen a contraction in all but their most essential lines (especially with patients unable to visit GPs); but basic foodstuff retailers have seen a boom.

These numbers are likely to see further dramatic shifts in coming months. Credit Benchmark data is now available on Bloomberg – high level credit assessments on the single name constituents of the sectors mentioned here can be accessed on CRPR <GO> or via CRDT <GO>.

[1] Borrowers moving from Investment Grade to High Yield

[2] Borrowers moving from High Yield to Investment Grade