Global transportation firms face higher risk of default if geopolitical tensions persist.

Supply chains have recovered from Covid, but key trade choke points face new risks. Global trade in goods runs at $25trn, and most of that passes through at least one of these points.

Attacks on Suez-bound shipping have pushed global cargo firms to re-route around Africa, adding time and cost; and drought disruption (not confined to summer) in Panama and the Danube are now annual occurrences. And supply chain disruption is one factor undermining early rate cut hopes as Central Banks tackle persistent inflation pressures.

Alternatives to shipping – road, rail and air – have their own issues, but are easier to re-route. Global transport volumes are forecast to double by 2050 so the quest for a robust and environmentally sustainable global supply system is becoming increasingly urgent.

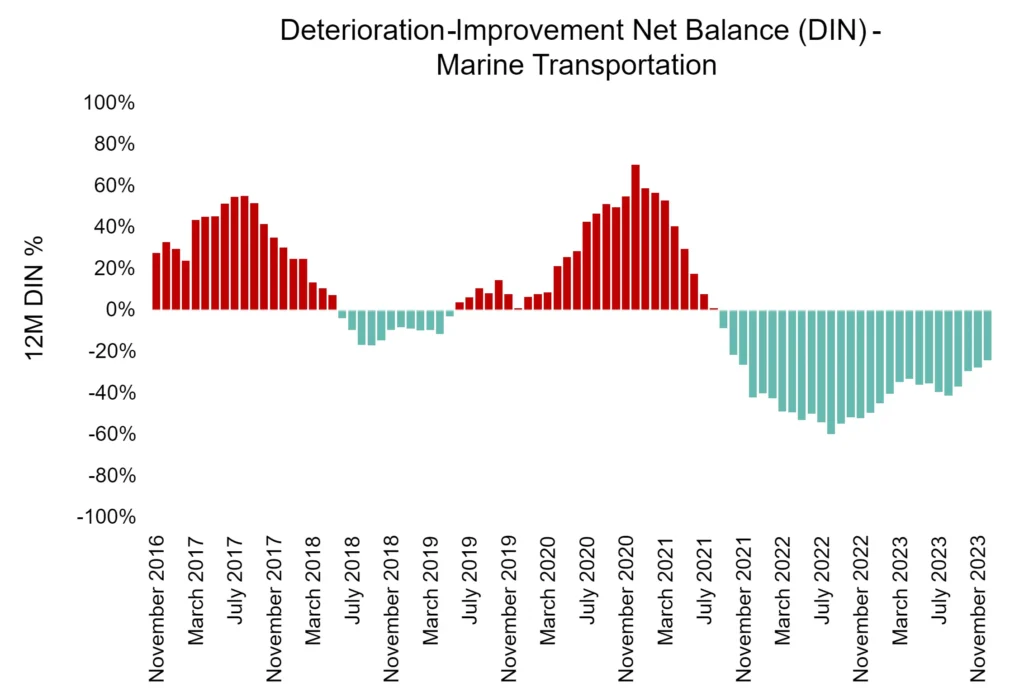

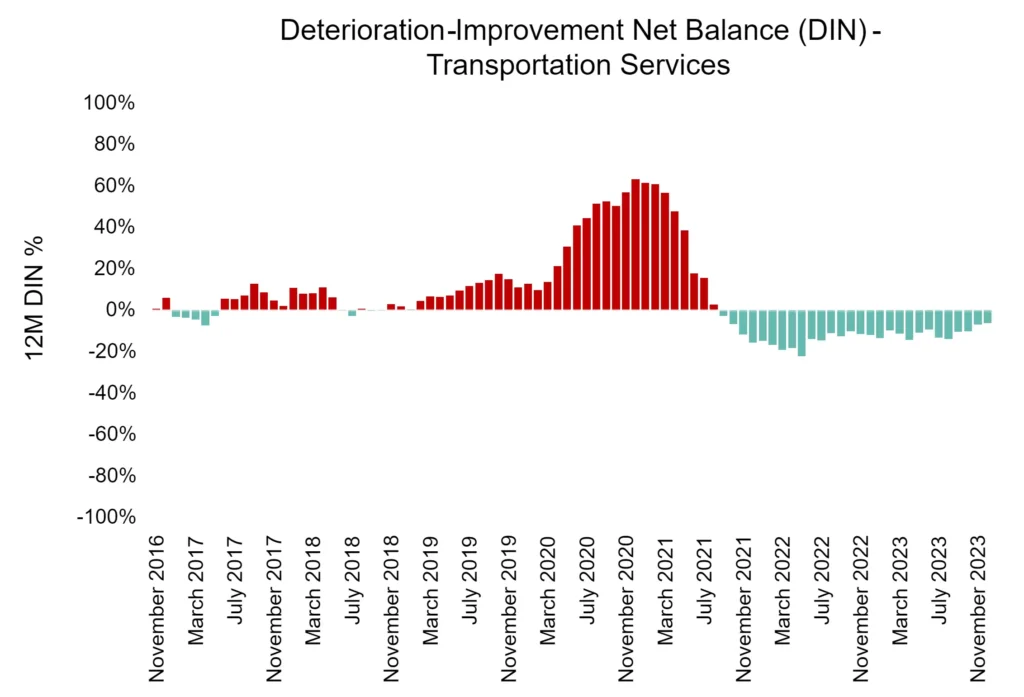

Future credit trends for global transportation firms can appear months in advance in Credit Benchmark’s Deterioration-Improvement Net (“DIN”) balance metric[1]. Balances above the line indicate a bias to higher default risks in borrower credit assessments.

Consensus data already shows some of the effects of supply chain disruption and higher interest rates: the charts below show the DIN metrics for Credit Benchmark’s Global Marine Transportation index (comprising 294 constituents) and Global Transportation Services index (2808 constituents).

Marine Transportation has seen a sustained bias to improvement over the past two years although this is fading; if trade disruption continues the balance is likely to shift towards deterioration and higher default risks.

Transportation Services show a similar peak during Covid but the recovery has been much more muted; although any shift to land or air transportation is likely to partly offset any maritime-related issues.

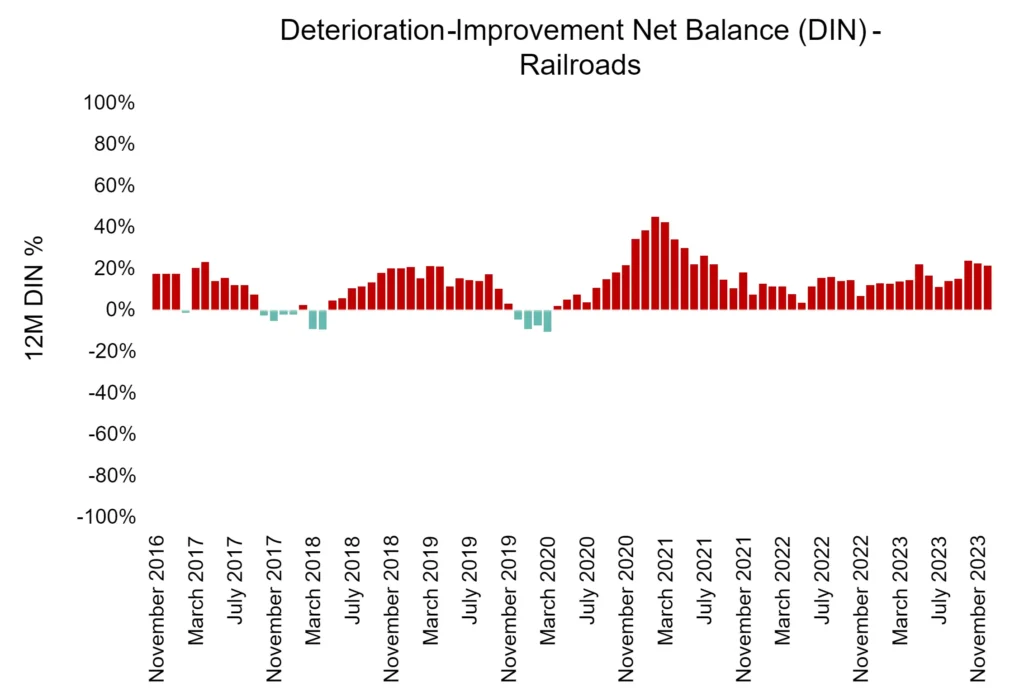

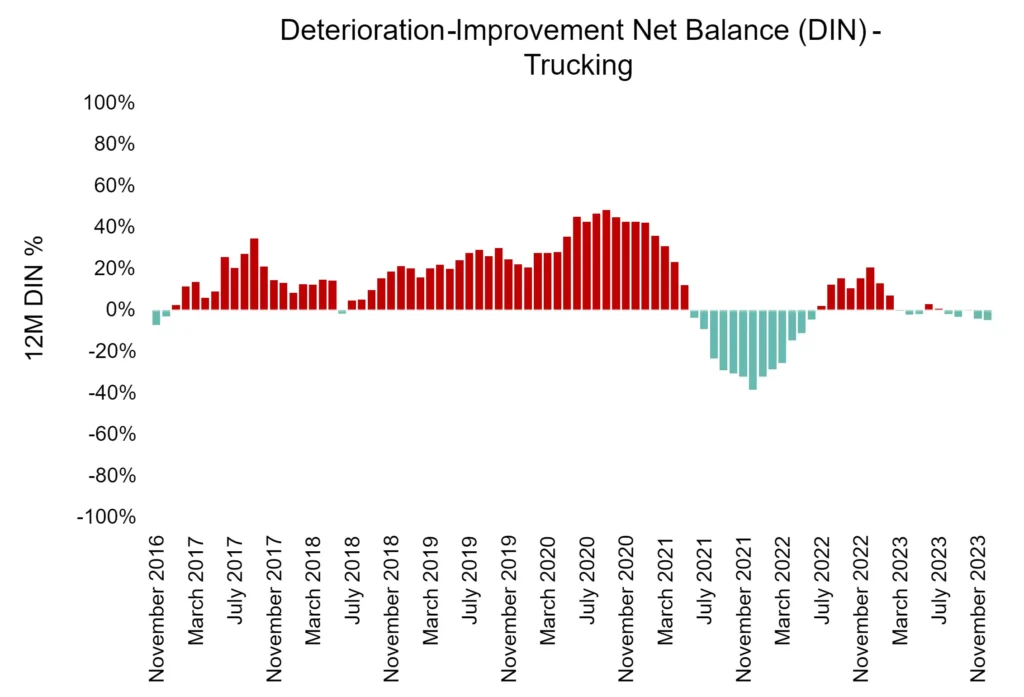

The next pair of charts show cumulative 12-month DINs for Credit Benchmark’s Global Railroads index (comprising 207 constituents) and North America / Europe Trucking index (371 constituents).

For Railroad credit, recent years have been difficult with no immediate sign of recovery, partly because passenger rail travel and short-haul freight is relatively expensive compared with air and road alternatives. But credit quality for some railroad firms could improve if shipping disruptions persist – rail can be cost effective over longer distances and has the lowest carbon footprint in the goods transport segment. It is also a significant beneficiary of automation and AI – but with a hefty ongoing investment requirement.

Trucking had a long negative credit streak both before and during Covid, and continues to give mixed signals after a year-long recovery in 2021/22. Trucking could benefit from shipping disruption – 40% of US trade with the rest of the world goes via the Panama canal and during trade flow peaks some of that might have to transit the US overland instead – spread across road and rail.

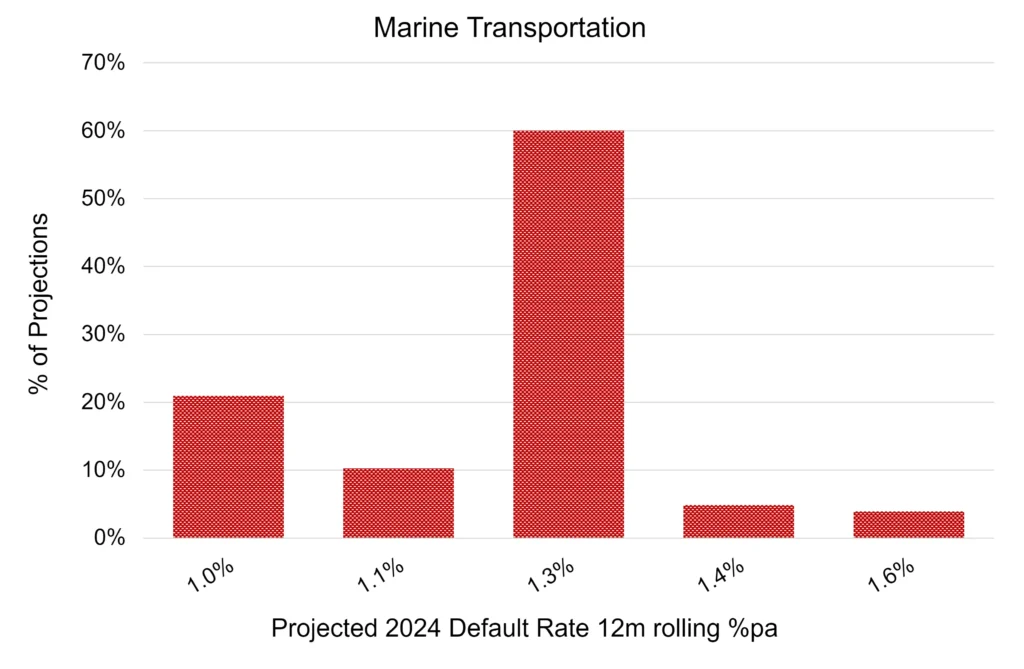

Suez and Panama have an impact on trade flows, freight rates, as well as the broader economy. But so far, apart from higher costs and longer lead times, the global economy has absorbed these shocks. Credit Benchmark’s default rate projections for Marine Transportation predict a slight increase in default risk as the most probable outcome in 2024; the chart below left shows the likely range.

The median default risk estimate for the past 12 months is 1.2%; this looks likely to rise to 1.3% but the pessimistic scenario shows an increase to 1.4% – 1.6% – a one-third jump in expected loan losses. But the chances of this happening are less than 10% on current trends and cycles. There is a reasonable chance (20%) of a drop in credit risk, although that would probably require reduced Middle East tension and a resurgent European economy.

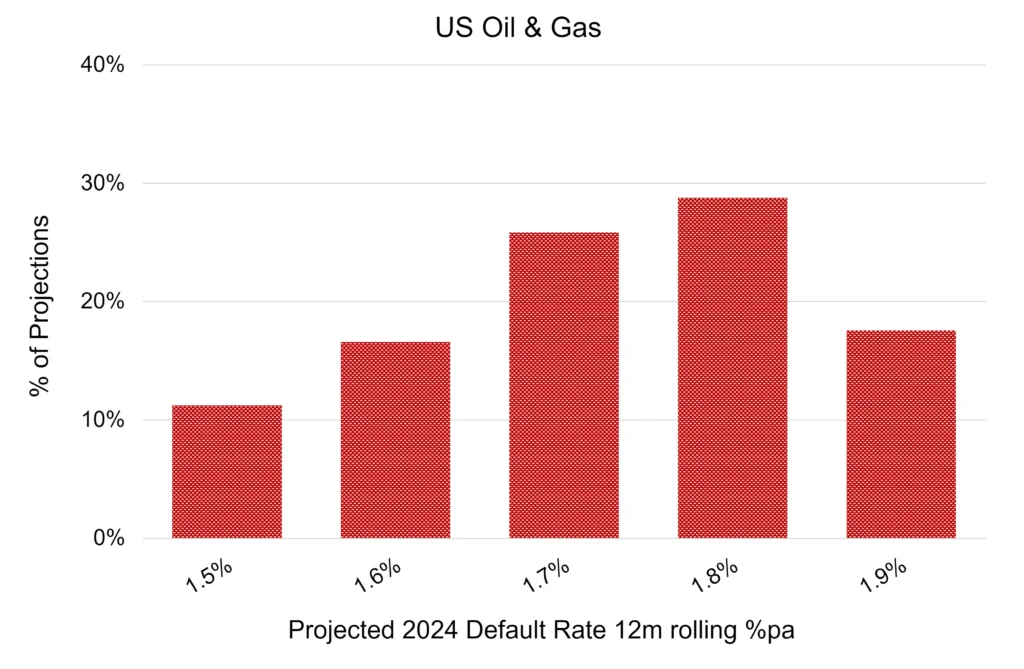

Our default rate projections for the US Oil & Gas sector are already optimistic (see chart above right, from the 2024 Default Risk Outlook on US Industries available here). If Middle East tension continues to deteriorate, self-sufficient US Oil companies will likely follow the optimistic credit scenario in 2024 with projected default rates in the Investment Grade zone.

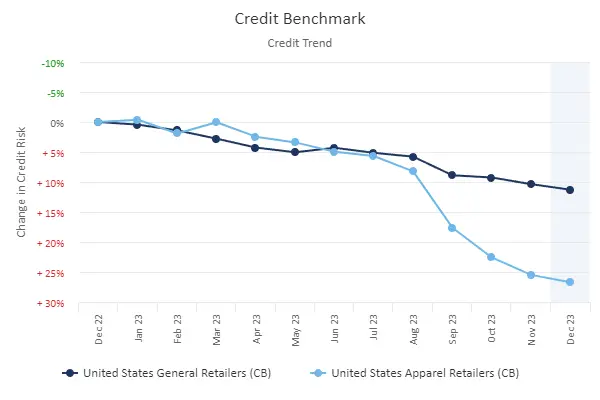

In the broader economy, the main effect of Suez bottlenecks will be felt in Western European and Turkish consumer goods sectors. But US Retailers have some dependence on both Suez and Panama for supplies; the chart below shows recent default risk trends for two Credit Benchmark US Retail indices.

Apparel in particular has seen a sharp deterioration in recent months. Since the end of 2022, US Apparel Retail credit risk has increased by more than 25%, most of that in the past 4 months – which seems unusual against the backdrop of strong wage growth; and general retailers show a 10% increase over the same period. So supply issues may be a significant factor for apparel specifically, much of which is sourced in Asia.

For detailed US Industry default rate projections for 2024 see the Default Risk Outlook. For a specialised view of a particular sector, get in touch at [email protected].

Download

Please complete your details to download the PDF of this report:

[1] “Deterioration” is any default risk increase for any borrower in a sector universe; “Improvement” is any default risk decrease. The Net balance is the difference between the two, as a percentage of the total number of borrowers in the sector. This is plotted here as a 12-month rolling total which often shows clear cycles. A sustained deteriorating net balance shows up in higher projected default rates after about twelve months.