In Numbers

100,000

Entities with Credit Consensus Ratings

130,000

Bond and Loan Rating Assessments, Representing $34+ Trillion Outstanding

1 Million

Risk Observations Feeding Into Twice-Monthly Data Updates

60 Million

Credit Risk Observations Collected Since Launch in 2015

1,200

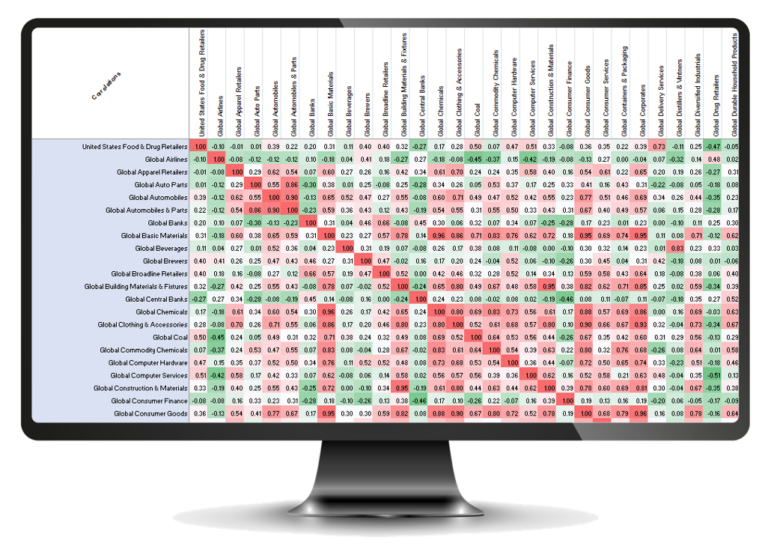

Industry & Sector Indices

160

Countries Covered

40

Major Global Banks Contributing, Almost Half Are GSIBs

20,000

Credit Analysts Contributing Risk Views

90%

Of Universe Unrated by Traditional Rating Agencies

90%

Of Corporate Universe Are Private Companies