Structured Credit / Securitization Team

Credit Consensus Data for Risk Sharing Transactions

Why Credit Benchmark?

Credit Benchmark data can help drive efficiencies and transparency in your risk sharing business

Significant Risk Transfers, also known as Capital Relief Trades, are growing in popularity as banks seek to release and redeploy regulatory capital, and investors are looking to benefit from exposures to bank-owned assets.

As a result, investors require a higher level of informational transparency than what is currently available in the market to ensure that they invest in portfolios that accurately reflect their risk / return profile.

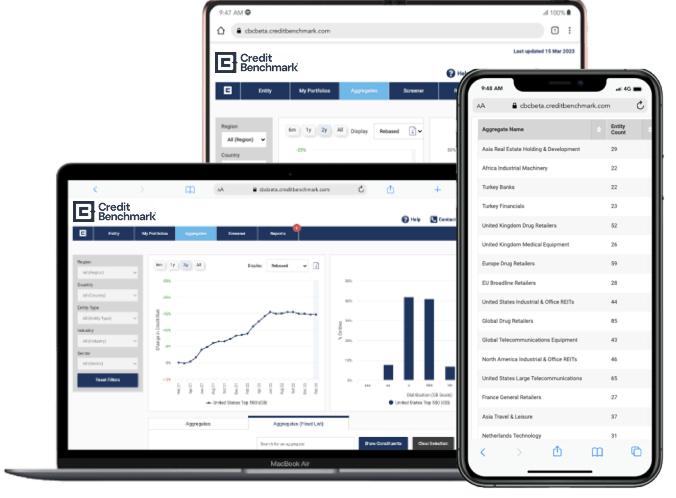

Credit Benchmark’s consensus data and analytics are increasingly utilized by a growing number of investors and issuing banks for greater trade intelligence as market conditions become more challenging.

Solutions

How we can help your business

Quickly measure the credit risk of a portfolio across publicly rated and unrated obligors, and pinpoint areas of potential concern for further analysis.

Venture into new geographies with the largest global source of credit risk data, benefiting reinsurance solutions by reaching otherwise opaque markets.

Complement issuer-sourced information, putting an issuing bank’s credit view into the context of those of leading global peers with real-world exposures; identify large outliers and systematic bias.

Fill in the gaps in the portfolio on unrated or unknown names, supporting capital relief trades by making trades more efficient and securing appropriate pricing.

Track divergences between Credit Consensus Ratings and credit rating agencies for a more up-to-date view of risk and leverage in pricing meetings, benefiting credit risk transfer strategies.

Enhance investor understanding of the risk profile of undisclosed portfolios with industry, sectoral or geographical risk indices, providing valuable insights for portfolio risk management.

Case Study

The Client

The portfolio management team within a leading European private money management firm, conducting capital relief trades with European banks.

The Challenge

A lack of public ratings, and data staleness for those which were available meant assessing the risk of a new trade was difficult. This was especially true when trying to enter new markets where reliable credit risk data is scarce. These obstacles also made it harder to monitor changes in the risk profile of existing portfolios.

The Solution

Credit Benchmark’s strong coverage on publicly unrated names granted the client confidence to undertake more trades and better monitor their existing portfolio for changes in risk. Noting divergences between Credit Consensus Ratings and traditional agency ratings was important to the client as they considered the bank-sourced consensus view as more trustworthy and up-to-date, and this allowed them leverage in pricing meetings. The provenance of the data based on the internal risk views of over 40 leading global banks also gave them comfort given the fact their trading counterparts are part of a peer group of the same banks providing their risk views to the credit consensus.

In Numbers

Entities with Credit Consensus Ratings

entities, 130,000 Bond and Loan Rating Assessments, Representing $34+ Trillion Outstanding

Risk Observations Feeding Into Weekly Data Updates

Credit Risk Observations Collected Since Launch in 2015

Industry & Sector Indices

Countries Covered

Major Global Banks Contributing, Almost Half Are GSIBs

Credit Analysts Contributing Risk Views

Of Universe Unrated by Traditional Rating Agencies

Of Corporate Universe Are Private Companies

The Benefits of Consensus Credit Data

Unparalleled coverage

Unparalleled coverage of public and private issuers; filling the gaps left by traditional ratings agencies.

Robust methodology

Free from “issuer-pays” conflict and any bank bias.

Real-world perspectives

Driven by the credit views of >40 of the world’s largest regulated banks, almost half of which are GSIBs.

Identify that entity

Risk data is processed through a sophisticated purpose-built mapping engine.

Up-to-Date, in The Know

The consensus is refreshed weekly to provide dynamic indicators of potential credit risk changes.

Alerting and monitoring

Assess risk over the lifetime of a transaction.

Secure reporting

Ease of internal integration within reporting.

Safety in numbers

A unique growing global dataset.