A chain is only as strong as its weakest link – and with international political tensions causing disruption to trade networks worldwide, global supply chains are being put to the test.

The US-China trade war has triggered major readjustments to existing global supply chain networks. US Farmers have seen a 38% drop in exports of U.S. farming produce to China since the first measures were announced, while China has seen 30% of their exports severely hit by tariffs.

But nature abhors a vacuum, and new suppliers are filling the gaps. Vietnam has been a major winner, with increased exports to both the US and China growing adding 2% to the nation’s GDP. This has not gone unnoticed – Vietnam is already in focus for the US to impose similar tariffs. So smaller nations may benefit, but only if they can stay off the US radar. And they will face the additional challenge of remaining competitive if trade tensions are resolved.

The looming prospect of Brexit is another factor affecting global supply chains. Brexit has already created disruption, with far-reaching consequences regardless of how the negotiations play out. The UK also plays a key role in a number of global supply chains [Read our whitepaper on supply chains credit risk here]. So in the event of a no-deal Brexit, the effect of border delays, import/export tariffs and fluctuating exchange rates could have an impact on supply chains far beyond the UK.

In the midst of all this disruption, Trade Credit Insurance companies become an ever more vital cog to keep supply chains moving. One of the purposes of trade credit insurers is to mitigate geopolitical risks by assuring businesses of ongoing income in the face of disruption. Higher risk means higher premiums so trade credit insurance costs could rise.

So far this year, the number of insurance claims made by UK businesses facing bad debts has reached its highest level in ten years according to latest figures from the Association of British Insurers (ABI). The figures show a 6% increase in company insolvencies in the first quarter.

Credit risk transparency is key to terms and pricing for trade finance policies, and increased transparency is especially critical for smaller companies where publicly available information does not exist. Credit Benchmark’s unique coverage of 50,000+ individual entities and forward-looking Loss Given Default (LGD) data allows insurers to price more accurately and conduct business more confidently with more trading companies.

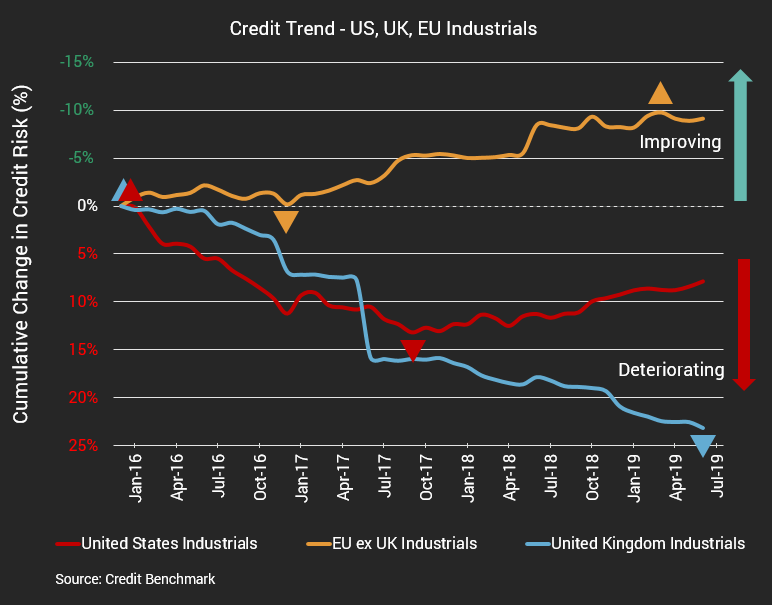

Credit Benchmark Aggregates offer insights into the credit trends of industries and geographies, pinpointing credit deterioration in sectors and supply chains of interest to insurers and helping inform future underwriting strategies. Comparing the recent credit trends of UK, US, and EU ex-UK Industrials shows that UK companies have struggled recently, with a steady decline in credit quality over the past 3+ years. Post-Brexit vote uncertainty has had a far-reaching effect on the sector. US companies have also deteriorated over this period but to a lesser extent, and have in fact shown modest improvement in the last year. European Industrials have fared much better, and though the sector will certainly experience disruption to UK trading as Brexit progresses, EU companies can rely on the security of a network of pre-existing trade agreements.

.

Further insights into how Consensus data can assist with mitigating supply chain credit risk can be found in our previous whitepaper on the topic.