This month has been one of the wettest Februarys on record and the increased rainfall has seen much of the UK impacted by severe flooding, with forecasters issuing warnings of further deluges in the coming days and weeks.

One UK study suggests that there are 70,000 uninsured homes in England built in areas at high risk of flooding. As extreme weather events increase in frequency, these high-risk areas have the potential to become “flood ghettos” populated by unsellable homes and offering no incentive for small businesses to set up shop.

While the insurance and mortgage risk of increased flooding is evident, how will banks with exposure to flood-affected businesses fare if extreme weather persists? The Bank of England has recently announced a BES consultation to stress test the financial implications of climate change and to test Banks’ resilience to climate change associated risks. As well as the physical risks of damage to property and infrastructure caused by flooding, indirect risks to businesses and thus their lenders include restricted customer and supply chain access due to road and rail closure, and increased insurance costs reducing profit margins.

Credit Benchmark collects UK Small and Medium Enterprise (SME) Probability of Default (PD) data from all major UK Banks as part of their credit portfolio benchmarking service. The SME dataset consists of over 140,000 monthly observations and these observations can be linked by postcode to UK Environment Agency Flood Risk data to help analyse sensitivity to flood risk areas across the UK Corporate SME population.

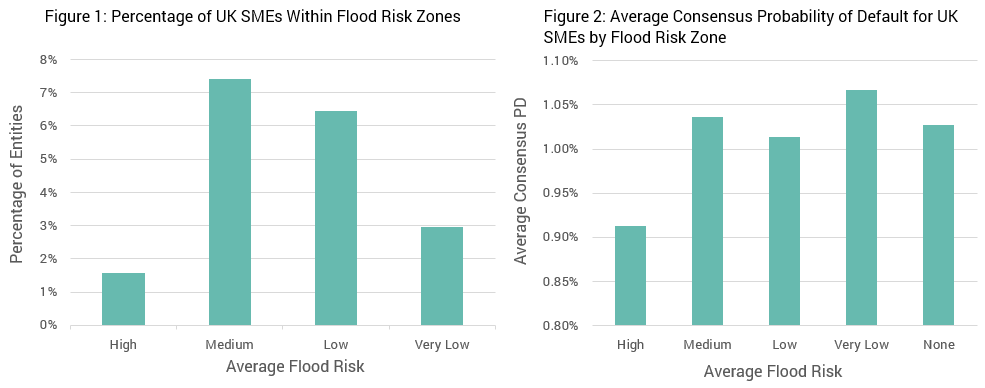

The data reveals an interesting disconnect between areas at risk of flooding and the average PD of SMEs in the same geographic area. While roughly 20% of all UK SMEs are located within an area at some risk of flooding, and almost 10% of these present a medium to high risk (see Figure 1), bank data does not reflect comparatively heightened credit risk for these vulnerable SMEs (see Figure 2).

While these results suggest that there are other drivers of credit risk influencing the Banks’ credit views of their SME customers, consensus PDs appear to currently show no clear link between different levels of flood risk and differences in portfolio credit risk.

Our full report on UK SME Consensus PD Data in Flood Risk Areas is available to download now, and contains further insights into SME flood risk.