While oil demand is expected to grow moderately in 2019, it is still below the strong growth expected in the non-OPEC supply forecasted for this year. This highlights the continued responsibility of participating oil-producing countries to avoid a relapse of the imbalance, and to continue to support oil market stability in 2019.

Recent healthier data from the United States and China is easing concerns about the economy and bolstering prices. Last week, oil prices hit their highest level so far in 2019 as the US considers new sanctions against Iran, while further Venezuelan disruptions could deepen an OPEC-led supply cut.

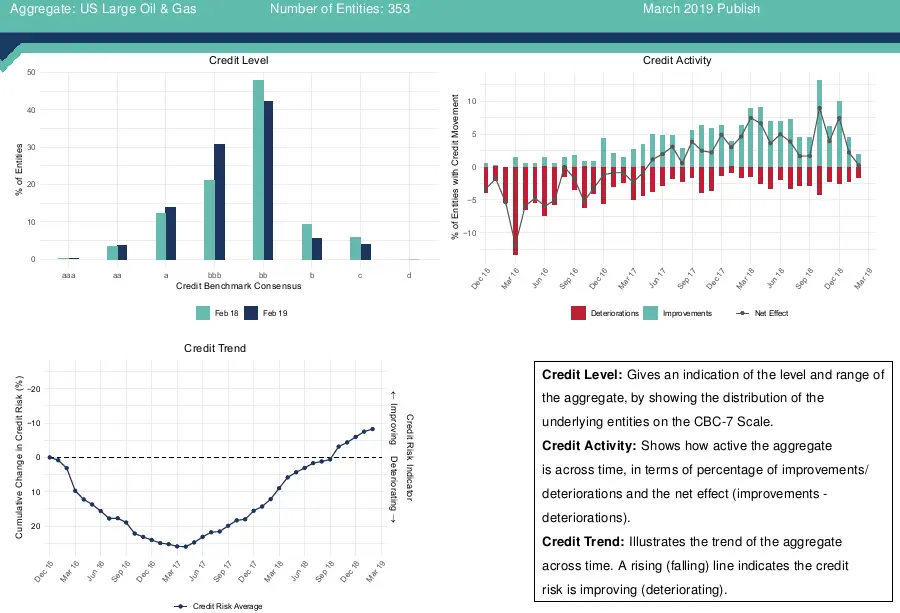

These trends collectively have been consistently reflected in the sector consensus credit risk views of 30+ global financial institutions on 353 US Large Oil and Gas companies in aggregate.

Chart 1 (Credit Level) shows the largest category is bb, with the proportion decreasing over the last year.

Chart 2 (Credit Activity) shows that overall downgrades outnumber upgrades in 17 of the previous 39 months; the net balance was positive throughout 2018 but this has dropped sharply in recent months.

Chart 3 (Credit Trend) shows steady improvement since May 2017. From trough to peak, the swing towards improvement represents about a 15% decrease in credit risk. However, if the net balance in Chart 2 continues to drop, credit risk improvements are also likely to stall.