The latest whitepaper from Credit Benchmark reports on major credit trends for the period 2016-2018.

It covers the main industries in the US, UK and EU ex UK, as well as Technology, Oil, Airlines and Sovereigns.

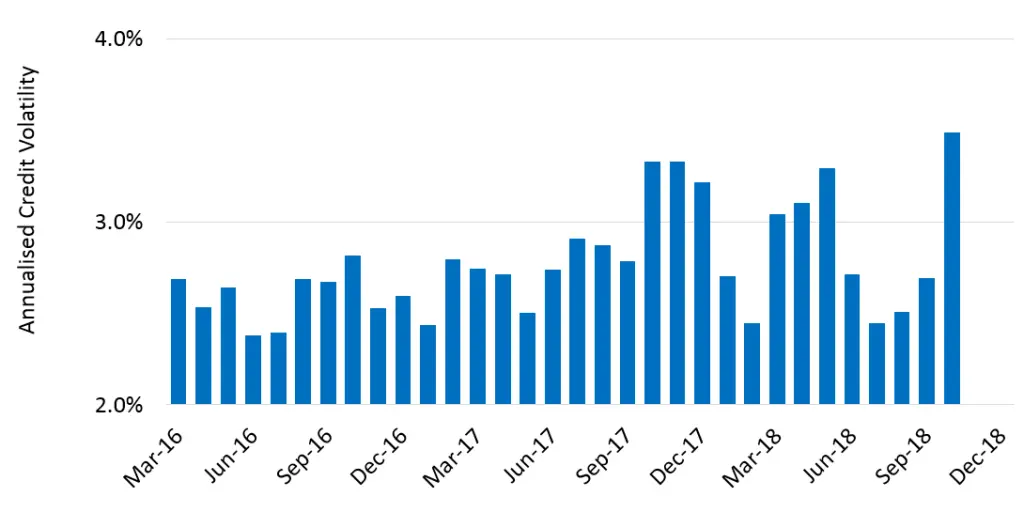

The main conclusion is that credit risk assessments are becoming more volatile – which may signal increasing concern about the uncertain timing and scale of any forthcoming increase in credit spreads.

Credit Volatility 2016-2018

Some other key conclusions:

- USA, Inc.: The Republican administration has been credit-positive for most US financials and corporates, but Silicon Valley companies have lagged.

- Brexit: Uncertainty appears to have been negative for most UK industries, although UK Banks have seen less impact. During this period of uncertainty, EU ex UK industries show some very divergent trends.

- Global: The Oil credit recovery may have run its course, but Airlines continue to improve.

- Sovereigns: Trade wars and geopolitical tensions have been negative for Emerging and Frontier Sovereigns; Developed Sovereigns have seen little impact.

To access the full whitepaper, please provide your details below.