The IMF anticipate a global recession following the COVID-19 lockdowns. A sharp spike in corporate defaults is inevitable, but this will be mitigated by various Government support programs.

Financial history is littered with economic and financial crashes followed by waves of defaults, but this biological crisis is almost unprecedented. Perhaps the nearest equivalent is the Spanish Flu pandemic of 1918-20, estimated to have reduced Global GDP at the time by about 18% over a three-year period. COVID-19 is expected to lead to a 25% reduction in three months.

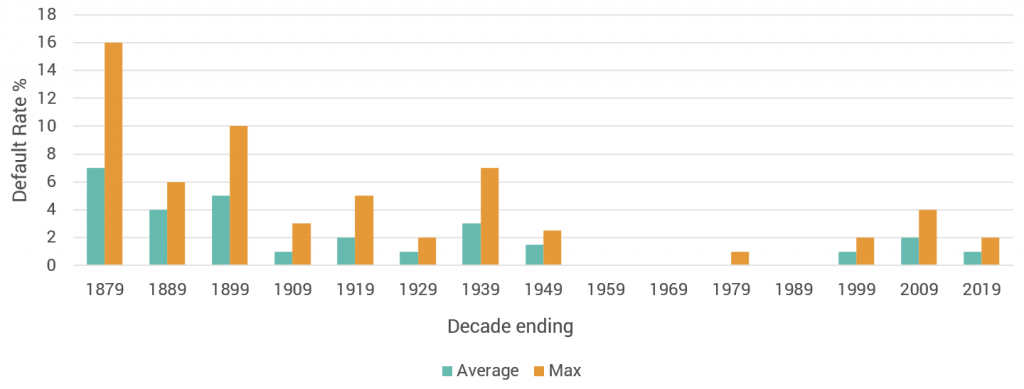

For historical context, it is useful to look at the 150-year default rate study published by the NBER* in 2010. Figure 1 shows the NBER series spliced with more recent data from various sources.

This highlights the dramatic decline from the late 19th Century to the second half of the 20th Century. Since then, the average and maximum default rate has risen slightly.

Addressing the COVID-19 crisis, a new paper by Professor Ed Altman** summarises predictions from various sources for High Yield borrower defaults in 2020. These range from 5% to 20% representing levels that in some cases have not been seen for decades. Defaults on this scale may occur as supply chains collapse while heavily indebted companies are unable to access Government rescue schemes.

If working from home becomes more typical and if social distancing is the new normal, then the recovering economy may have a very different structure. With echoes of Schumpeter, it is possible that high levels of company departures will be mirrored by the arrival of many new types of technology driven businesses. Supply chains will be shorter, more diversified, more local; and inventory levels will be higher. Higher cash levels and strong balance sheets will be back in fashion.

Credit migration data provides powerful clues about how default rates are likely to change. Consensus credit estimates suggest that one-year default probability estimates in the range of 15 Bps to 48 Bps correspond to the BBB category. Those in the BB category range from 48 Bps to 255 Bps, and in the B category from 255 Bps to 1000 Bps.

If 30% of a portfolio of BBB loans migrates to BB, the average Probability of Default for those loans can more than double. If some of those migrate to the B category, default risk can more than triple.

To assess the impact of the COVID-19 crisis on future default rates, Credit Benchmark will be providing regular reports on these migration rates.

.

References:

*Giesecke, K., Longstaff, F.A., Schaefer, S., Strebulaev, I. (2010),”Corporate Bond Default Risk: A 150-Year Perspective“, [Online]. Available at: http://www.nber.org/papers/w15848. Accessed 20th April 2020.

**Altman, E. (2020), “The Credit Cycle Before And After The Market’s Awareness Of The Coronavirus Crisis In The U.S“, [Online]. Available at: https://www.creditbenchmark.com/wp-content/uploads/2020/04/Altman-2020-Credit-cycle-before-and-after.pdf. Accessed 20th April 2020.