Credit Benchmark have released the end-month industry update for end-December, based on the final and complete set of the contributed credit risk estimates from 40+ global financial institutions.

Corporate credit quality is in good health, according to credit consensus opinion this month.

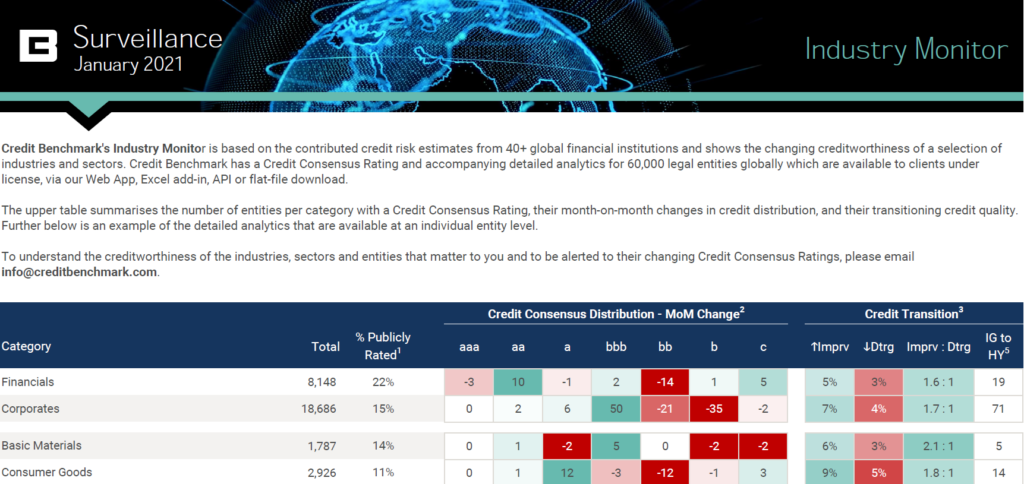

Financials and Corporates both showed a higher instance of improvements than deteriorations, with ratios of 1.6:1 and 1.7:1 respectively.

At an industry level, only Telecommunications showed overall deterioration, and this was extremely marginal with an improving to deteriorating ratio of 1:1.1.

Oil & Gas came out on top, with a ratio of 3.2:1. Other strong showers included Basic Materials at 2.1:1 and Consumer Goods and Technology, both at 1.8:1.

North American Oil & Gas takes the lion’s share of the credit for the industry’s strong showing, with US firms at a positive ratio of 7:1 and Canadian firms at 5.5:1. UK Oil & Gas firms were almost neutral, with a ratio of 1.1:1. This regional strength was also reflected at an overall Corporate level.

Construction & Materials was comparatively the weakest sector, at 1.1:1 improvements to deteriorations, though this still falls within positive territory. Travel & Leisure also had a mild month, at 1.2:1 – though this is a welcome change from a slew of negative ratios in recent history.

In the update, you will find:

Credit Benchmark will continue to provide regular reports on these migration rates. If you have any questions about the contents of this update, please get in touch.