Credit Benchmark have released the end-month industry update for end-November, based on the final and complete set of the contributed credit risk estimates from 40+ global financial institutions.

Consensus opinions continue to paint a brighter picture for corporate credit, with almost every category seeing more improvement than deterioration.

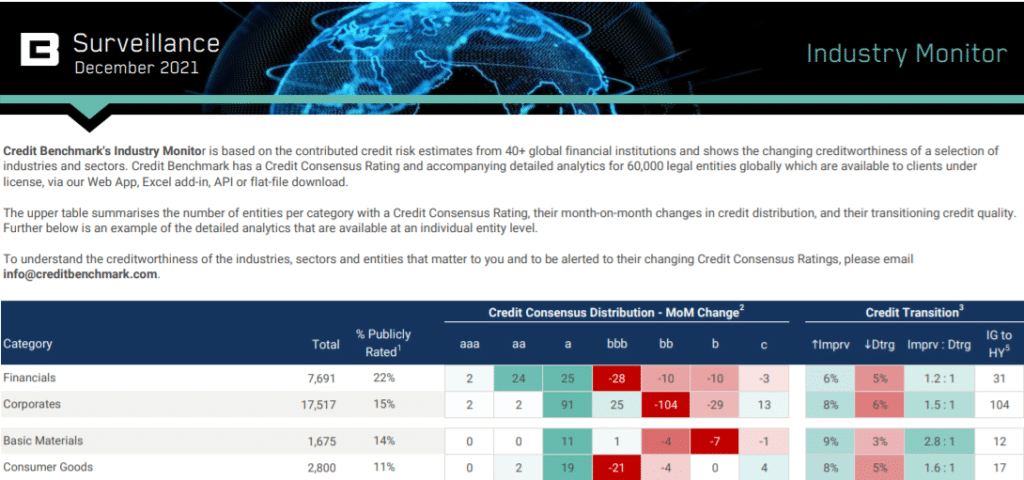

In the latest data, the broad category of Corporates has a ratio of 1.5:1 improvements to deteriorations. But within the sectors some stood out, including Basic Materials at 2.8:1, Telecommunications at 1.8:1, and Technology and Consumer Goods, each at 1.6:1. Others were just below, including Industrials at 1.4:1, and a handful hovered around neutral. Only Utilities saw more deterioration than improvement at 1:1.2.

At the regional level, Canadian Corporates were out in front at 2.3:1, compared to US Corporates at 1.9:1 and UK Corporates at 1:1 improvements to deteriorations.

The positive ratio for US Oil & Gas was strongest at 3.3:1, compared to 1.6:1 for Canadian Oil & Gas and 1.4:1 for UK Oil & Gas. Not only was this far better than the ratio for the broader Oil & Gas category which is 2.2:1; it’s the best ratio of all the categories tracked.

Financials also saw more improvement than deterioration with a ratio of 1.2:1.

According to David Carruthers, Research Adviser at Credit Benchmark:

“While there continues to be more positive than negative in corporate consensus data, there are no shortage of pressures, from supply chain challenges to growing inflation to continued uncertainty around COVID restrictions. Monetary tightening is also a factor. It’s yet to be seen if this improving trend will persist, but for now, the situation is plainly positive.”

As noted previously, research from Credit Benchmark comparing improvements and deterioration for Global Corporates amid rising interest rates found them in balance but noted that this may turn negative in the coming months if and when central banks impose additional monetary tightening. The Federal Reserve is going to taper its asset purchases, and some are calling for it to happen more quickly. Many central banks in Europe are raising interest rates amid increases in inflation. The Bank of England didn’t raise rates at its last meeting, but Governor Andrew Bailey said he’s “very uneasy” about inflation.

Then there are supply chain challenges that continue to vex all types of companies amid the pandemic-era surge in shipping. There are no quick fixes, of course, and some believe problems may last well into next year.

But these issues and others like energy costs and inflation all tie back to the pandemic. It’s still limiting economic growth, even in developed countries, and it will act as an anchor on the global economy until more progress is made. Some are now calling for a quicker pace of monetary tightening.

In the update, you will find:

Credit Benchmark will continue to provide regular reports on these migration rates. If you have any questions about the contents of this update, please get in touch.