The UK could be the first major economy to increase short term interest rates over the next 12 months. With oil & gas prices spiking and consumers facing shortages and delays, interest rate futures are already discounting at least two UK rate hikes over that period, and Michael Saunders of the UK Monetary Policy Committee described the market view as “appropriate”.

A rate hike would add the Bank of England to a growing list of central banks who see inflation as a key near-term risk to economic stability. In the past 10 months, there have been 52 short rate increases and just 18 drops.

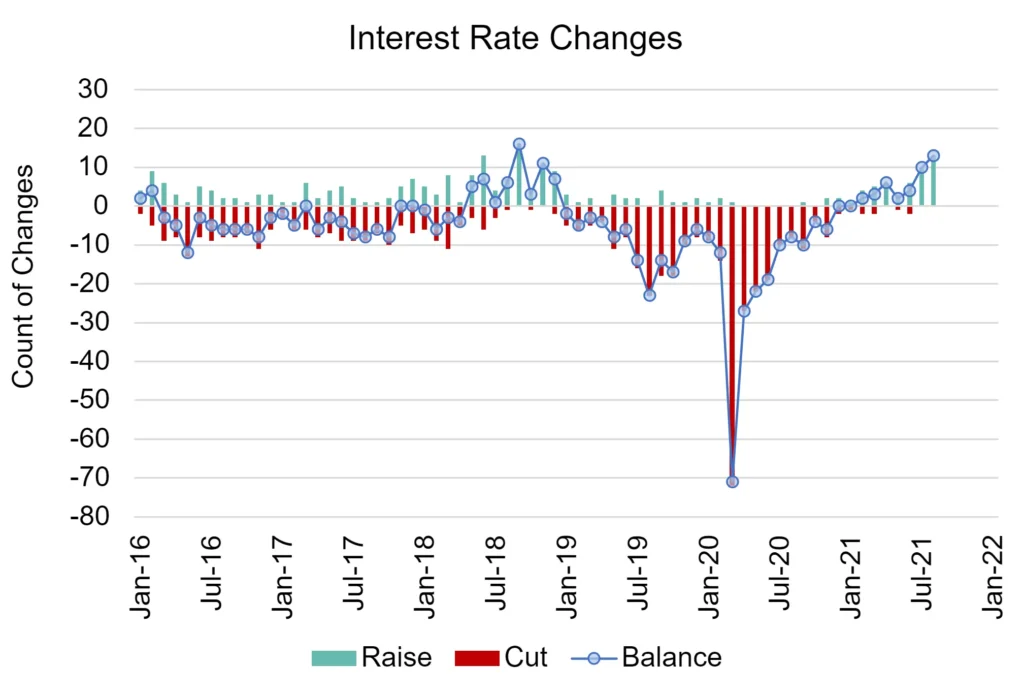

Figure 1 shows the pattern of interest rate increases vs. decreases over the past 6 years.

Figure 1: Central Bank interest rate increases vs. decreases, global

The tendency towards rate cuts over the period 2016-2017 was followed by a large number of small increases in 2018, beginning a significant reversal even before Covid. From the low reached in early 2020, the balance remained strongly skewed towards cuts until the start of 2021. Since then, there has been a modest trend towards rising rates; the latest positive balance is the highest since mid 2018.

Figure 2 shows an equivalent chart (upgrades vs. downgrades net balance) for global corporate credit [please continue below to access full report].