Download the End-December Industry Monitor infographic below.

Credit Benchmark have released the end-month industry update for December, based on the final and complete set of the contributed credit risk estimates from 40+ global financial institutions.

In the update, you will find:

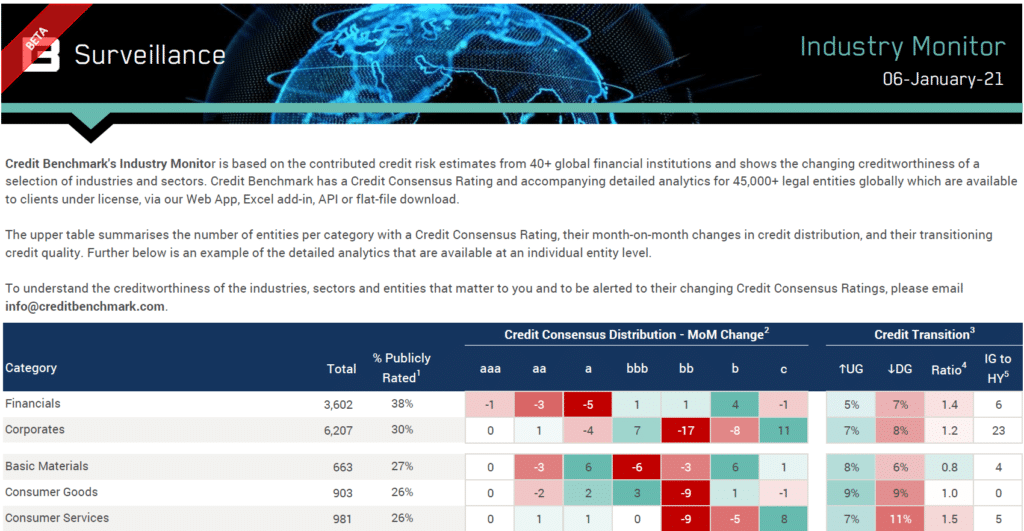

- Credit Consensus Distribution Changes: The net increase or decrease of entities in the given rating category since the last update.

- Credit Transition: Assesses the month-over-month observation-level net downgrades or upgrades, shown as a percentage of the total number of entities within each category.

- Ratio: Ratio of Deteriorations and Improvements in each category since last update, calculated as Deteriorations / Improvements

- IG to HY Migration: The number of companies which have migrated from investment-grade to high-yield since the last update (known as Fallen Angels).

Compared to the figures seen in the November End-Month Industry Monitor, the December End-Month Industry Monitor shows:

- Financials and Corporates have both seen an improvement in the deteriorating/improving ratio since the last update (the ratio for Financials has dropped from 1.7:1 to 1.4:1, and the ratio for Corporates has dropped from 2:1 to 1.2:1). Both groups remain biased towards deterioration, however.

- The majority of Industries and Sectors show a bias towards deterioration this update, but the incidence of positive or neutral credit ratio is growing. Last update, Utilities, showing a neutral credit trend, was the only industry not deteriorating. This month, three industries show a modest positive trend (Basic Materials, 0.8:1; Technology, 0.6:1; Telecommunications, 0.4:1), and Consumer Goods had a neutral deteriorating/improving ratio. Amongst the sectors, the positives included UK Oil & Gas (0.8:1) and Construction & Materials (0.9:1), while Canadian Corporates and Canadian Oil & Gas were neutral.

- Since last update’s neutrality, Utilities has now turned to deterioration, with a ratio of 2.1:1. Utilities was the worst performing industry this update. All other industries showed an improvement or no change in their credit performance compared to the last update.

- Amongst the sectors, Travel & Leisure was the worst performer, with a 4.1:1 deteriorating/improving ratio. However, this is an improvement from last update, when the sector showed a 7.9:1 ratio. All sectors showed some level of improvement since the last update.

- Corporates show a higher proportion of Fallen Angels (companies migrating from Investment Grade to High Yield) with 23 Fallen Angels (0.4% of total), compared to Financials, with 6 Fallen Angels (0.2% of total. Both groups saw fewer Fallen Angels than in the last update.

- The incidence of Fallen Angels fell across most industries and sectors this month.

Credit Benchmark will continue to provide regular reports on these migration rates. If you have any questions about the contents of this update, please get in touch.

For full details, please download the End-December Industry Monitor infographic here:

Download Industry Monitor