The recent Fed hike has brought renewed focus on the broader impact of rising yield curves. While bond markets have been pushing long term bond yields higher for some time, short term interest rates have been close to zero (or even negative) for a prolonged period. The Fed is not alone in tightening policy – an increasing number of G20 Central Banks are following suit. The combination of QE withdrawal and rising yield curves means that heavily indebted companies face an increasingly challenging environment. After years of loan extensions, commercial banks see a significant opportunity cost in continuing to support so-called “zombie” companies.

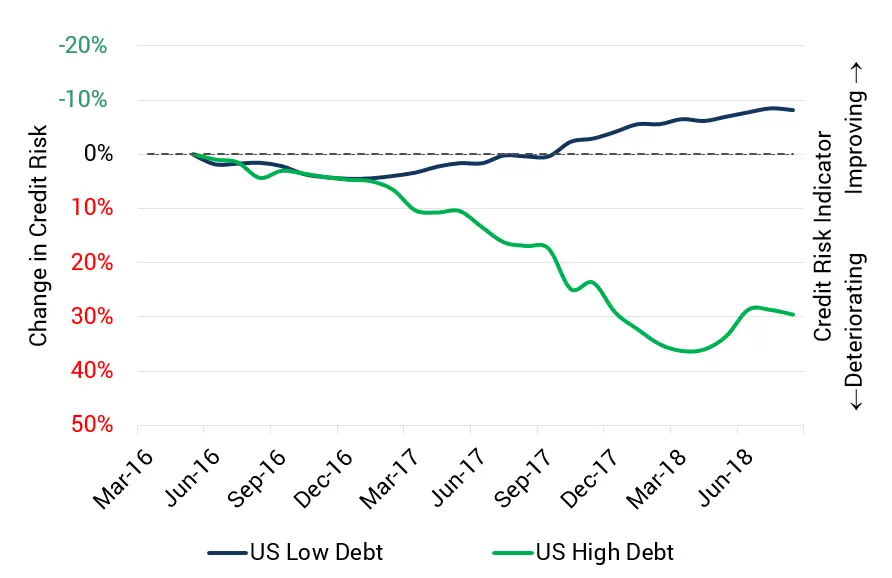

The chart shows credit trends over the past two years for around 500 US companies at either end of the debt spectrum. An upward sloping Credit Risk Indicator line means that average credit quality for that group of companies is improving (i.e. the probability of default is falling). A downward sloping line means that average credit risk is deteriorating (i.e. the probability of default is rising). The left hand axis shows the percentage change in default risk over the period.

Companies with low (<10%) debt ratios (Debt as a percentage of Enterprise Value) have seen their credit risk improving by more than 10% in the past 18 months. Those with high debt ratios of more than 75% – typically with already poor credit ratings – have deteriorated further, by nearly 40%.

This rate tightening cycle will probably take some time. For heavily indebted companies and their lenders, it looks as if this could be a particularly challenging period.