Is there any relationship between credit quality and sporting performance? Previous research by Credit Benchmark has shown a possible link using data from the 2016 Summer Olympics. Higher credit ratings are typically associated with mature economies, consistent growth, low inflation and a sound fiscal position; it seems likely that countries with high GDP per capita can devote more resources – public and private – to training for sport. With the Winter Olympics over for another four years, there is another opportunity to run an informal check on this hypothesis.

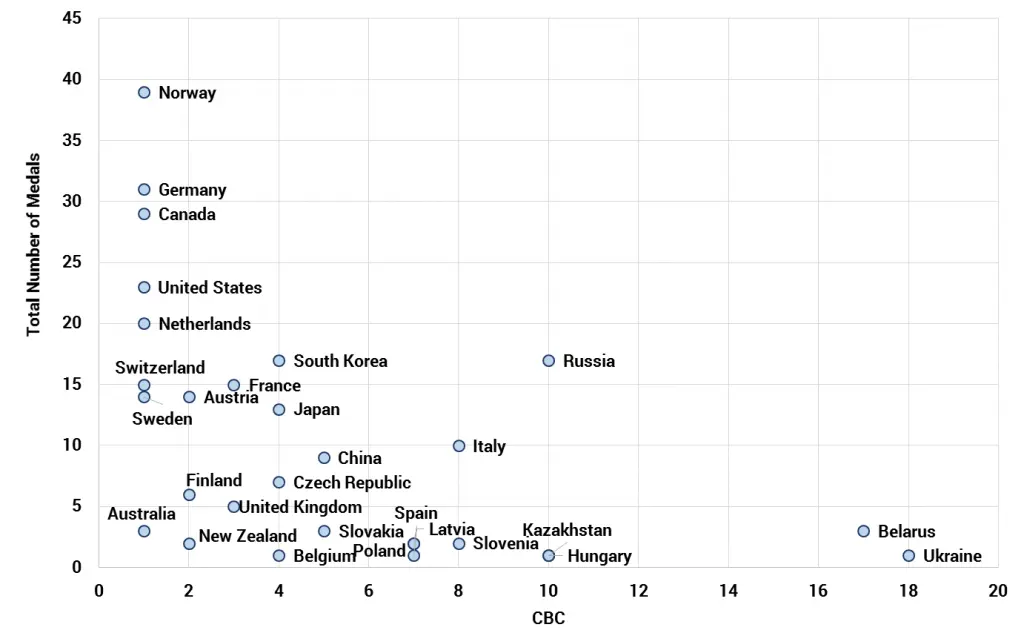

Exhibit 1 compares bank-sourced views of credit quality with the total number of medals achieved by participant countries.

Exhibit 1: Bank-sourced views of credit quality and Winter Olympics medal totals

Source: Credit Benchmark, www.pyeongchang2018.com

Exhibit 1 suggests that a relationship does indeed exist, and is similar to that of the Summer games. The typical medals/credit relationship passes through Norway, Germany, France, Japan, China, Slovenia, Hungary and Ukraine.

It is not surprising to see Norway at the top of a list of Winter Olympics winners, but there are less stellar performances from winter sports stalwarts such as Switzerland and Sweden, and a disappointing one from Finland. Canada is another unsurprising winner, whereas success for Germany and the Netherlands clearly required rather more dedication from a group of enthusiasts. The US benefits from a large population and a diverse geography to produce a steady stream of winter athletes.

The Korean home team reached a respectable total, in line with the overall medals/credit relationship. But joining Finland in the underperforming category are Belgium, Australia, New Zealand and the UK; all these countries have strong credit quality but winter sports training is clearly not a tradition or a priority.

The obvious outlier is Russia, and this was true for the Summer games as well. But unlike that competition, the official Russian team is currently banned from Olympic participation. However, the “Olympic Athletes from Russia” have still succeeded in gaining more medals than their credit quality would imply. These are mainly silver and bronze, but it could suggest – to those who believe that the spirit of fair competition is still alive – that a large population can overcome economic challenges to produce a decent set of sub-zero athletes if their winters are reliably cold enough.