Another day, another store closing – this is the current environment for UK retailers, with the Arcadia Group announcing this week the closure of 23 stores including Topshop, Dorothy Perkins and Miss Selfridge. These closures follow recent announcements that M&S will close 100 stores by 2022, and Debenhams’ ongoing administration woes.

Some retailers are determined to fight back – in response to flatlining Q1 sales, Urban Outfitters has announced the introduction of a new ‘clothes rental’ program, which it hopes will stymie the rising (and profit-damaging) practice of consumers purchasing and returning worn clothing. And discount retailers are frequently known to flout an economic trend as consumers turn to cheap and cheerful products – take for example Walmart’s growth of net income in 2008, 2009 and 2010 following the financial crisis. In the UK, discount retailer B&M plans to open 50 new stores over the next year, and has reported an annual profit increase of 8.7%.

While Brexit and a weak pound are the main explanations for the UK downtown, trade squabbles between the US and China are continuing to impact the retail & consumer goods industries in both of these large economies. The IMF has criticised tariff increases on the grounds that companies are likely to pass the cost directly onto consumers.

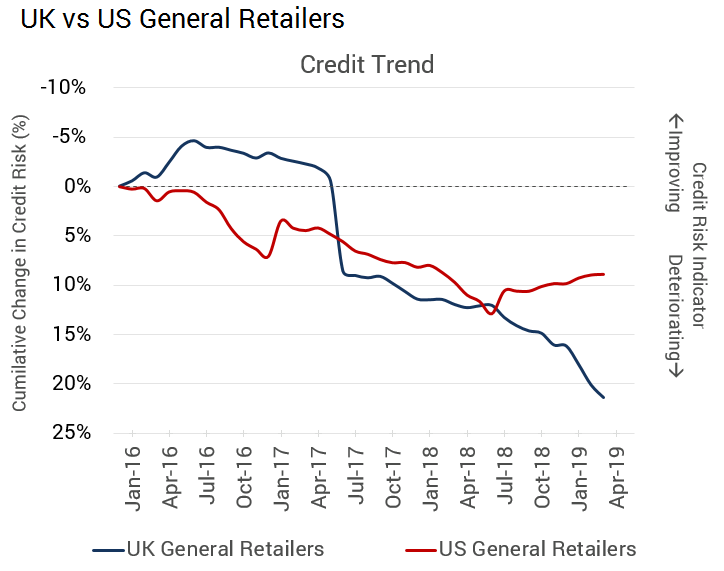

The charts below demonstrate the credit quality of international retail and consumer goods. Chart 1 shows the comparative credit trends of UK and US general retailers since January 2016. In the wake of the Brexit vote, UK retailers have seen a steady deterioration in credit quality. US retailers saw a similar but more modest decline and this has levelled off since July 2018.

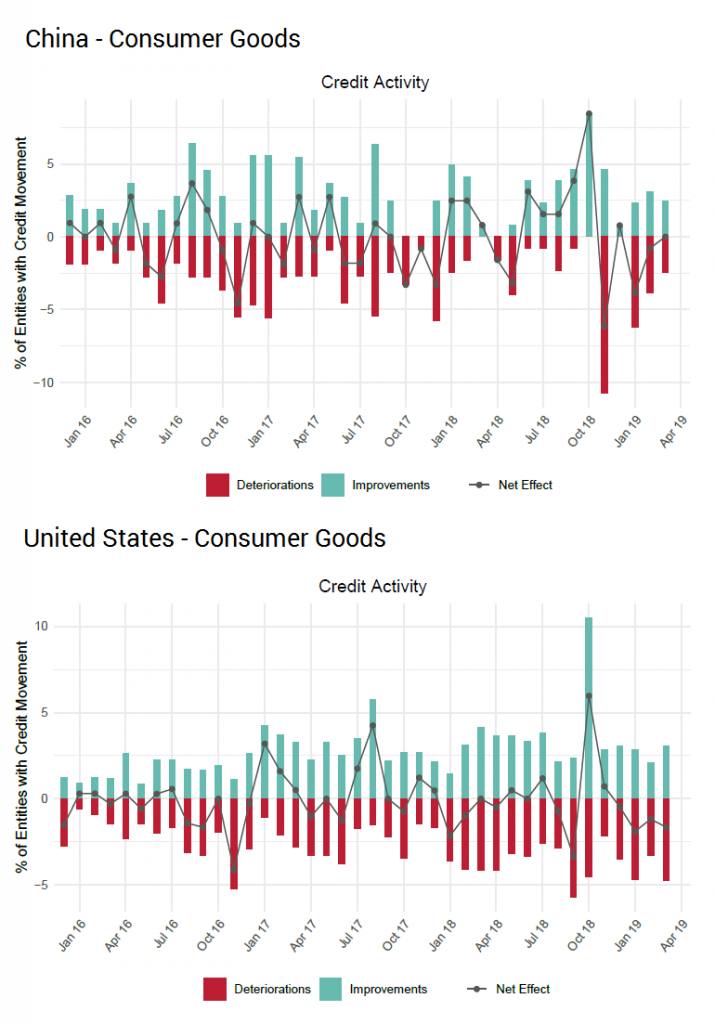

Charts 2 & 3 show the credit activity for Chinese and US consumer goods respectively. China has seen fairly stable activity since January 2016, modestly trending towards downgrades – until a sharp increase in downgrades in late 2018, coinciding with heightened trade disagreements with the US. The US sees a similar pattern until the swing towards upgrades in late 2018. Whilst China appears to be returning to equilibrium, the US has turned back to a negative balance – suggesting that the benefits of the trade war are still unproven.