The global construction industry is facing renewed challenges: just as the COVID-driven labour and materials shortages showed signs of easing, the Ukraine war is hitting the industry in two specific areas: steel and glass. The US typically imports 60% of its pig iron from Russia and Ukraine, while higher natural gas prices are hitting glass prices and supplies. Glass furnaces are not easy to restart after shutdowns, and the glass shortage has been compounded by the trend away from single-use plastic bottles as well as the demand for glass vials during the COVID vaccination program.

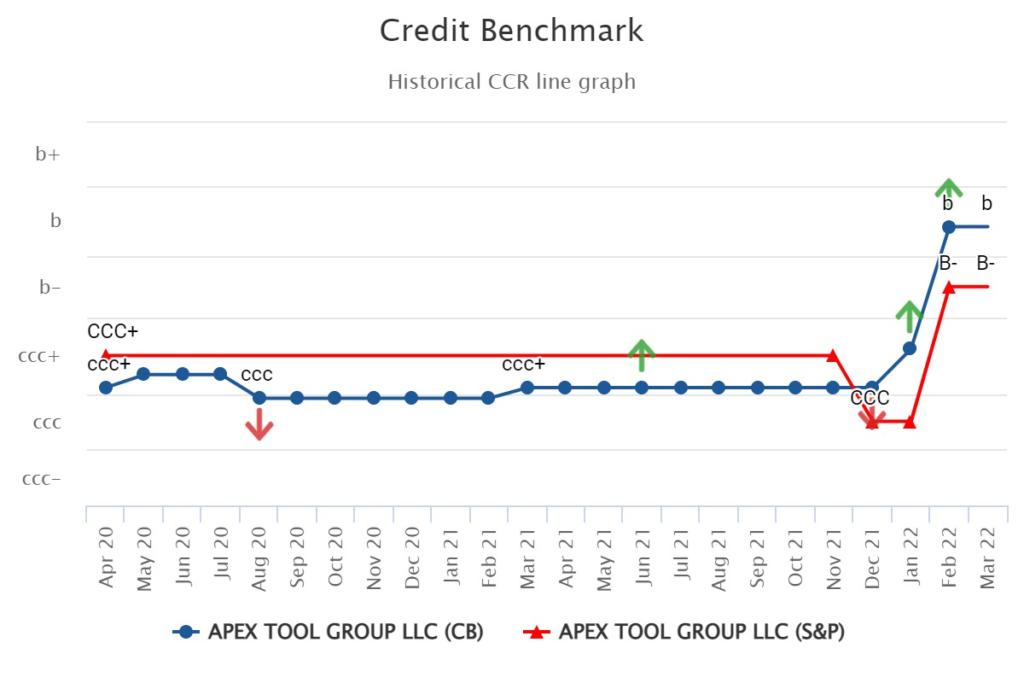

Prior to the invasion, credit risk for US Construction & Materials had improved especially rapidly as the pandemic eased, despite the highest cost-inflation rate in 50 years, and disruptions to building due to extreme weather in the US. The recovery matched that in Canada and outpaced that of the UK, EU and Global aggregates.

Figure 1: EU, Canada, Global, UK and US Construction & Materials aggregate probability of default; past two years.

Figure 2 shows the latest and one year ago US Construction & Materials credit distribution

Figure 2: Credit Distribution, US Construction & Materials; Feb-21 vs Feb-22

Over the past year, the credit distribution has shifted towards investment grade: there are no longer any entities in the c credit category and the bbb and a credit categories have expanded.

North American construction firms have some advantages compared with the rest of the world – large home-grown timber sources, more reliable energy supplies, and the continued demand as the spend from the $1.2trn infrastructure bill signed in late 2021 is rolled out. The Ukraine war is pushing the US to become self-sufficient in many industrial inputs; steel and glass will need to be high priorities if the infrastructure bill is to be kept on track.

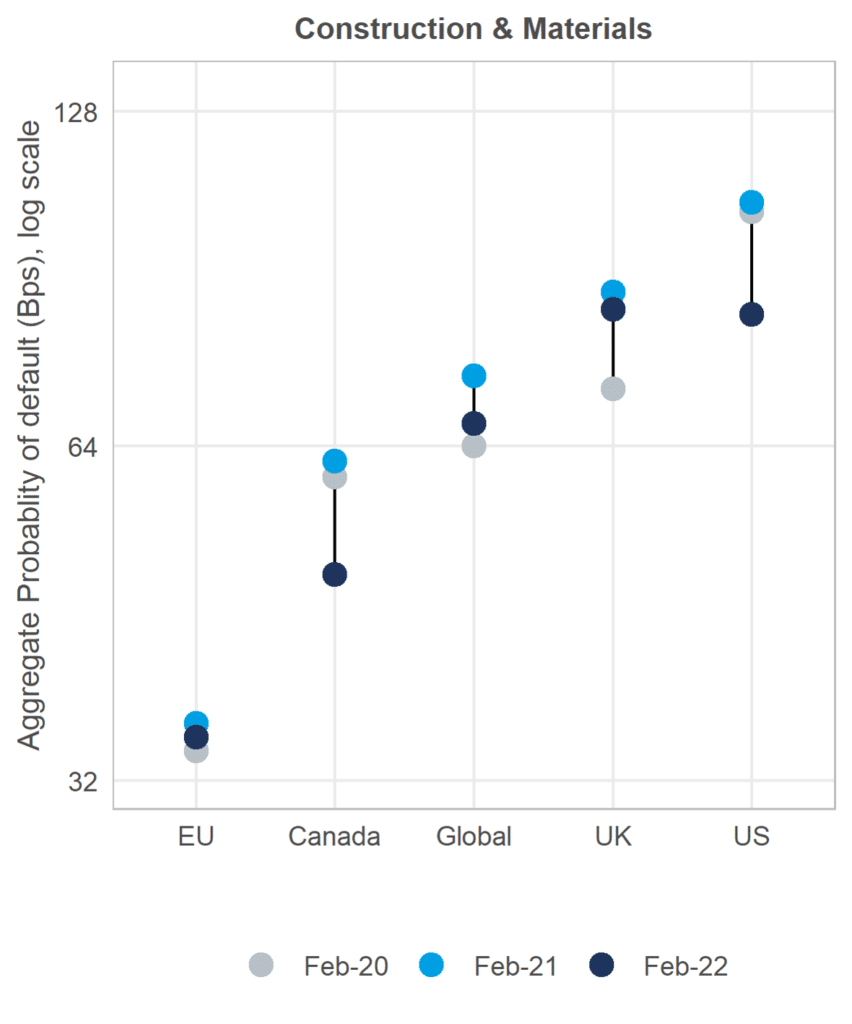

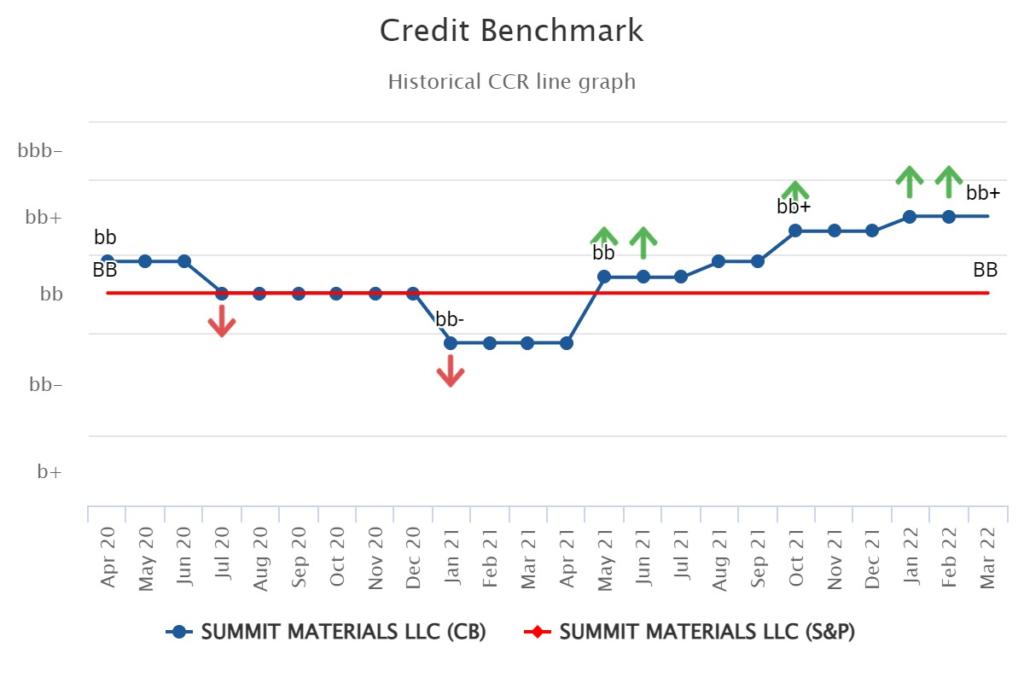

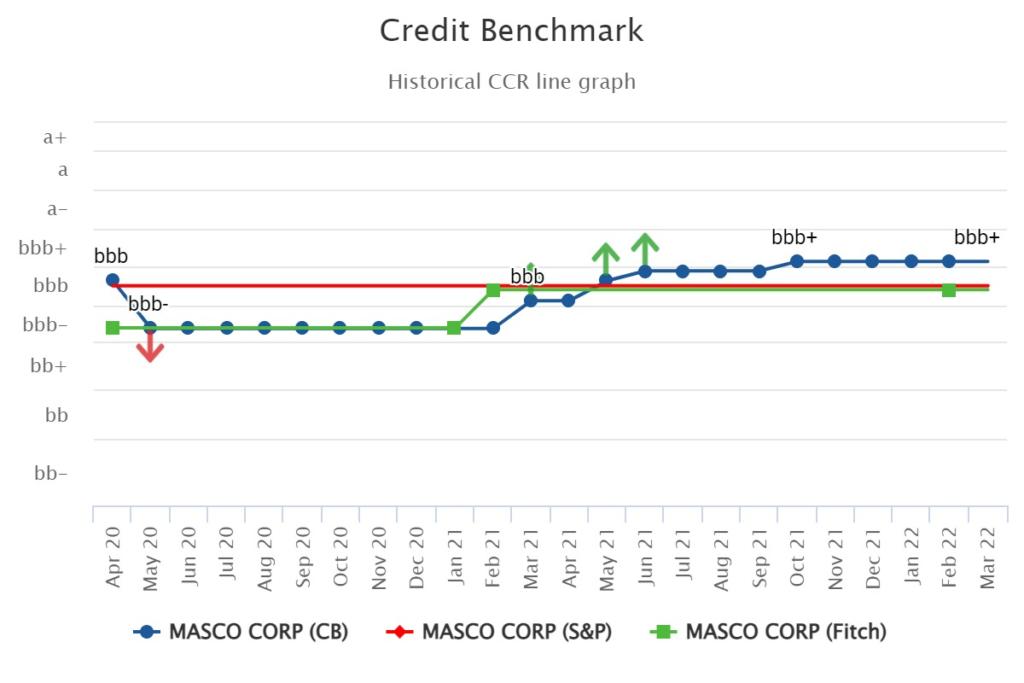

Figures 3, 4 and 5 show recent positive credit trends for three U.S. Construction & Materials companies: Summit Materials LLC, Masco Corp and Apex Tool Group – the next few months will be crucial for the sector credit outlook. Consensus data is now available on Bloomberg to track these and other changes across more than 30,000 global corporate issuers.

Figure 3: Summit Materials LLC, US-based aggregates producer

Figure 4: Masco Corp, US-based home improvement and new home construction products

Figure 5: Apex Tool Group, US-based hand and power tools