Recent bank failures and mergers have uncovered transatlantic tensions in the global banking sector.

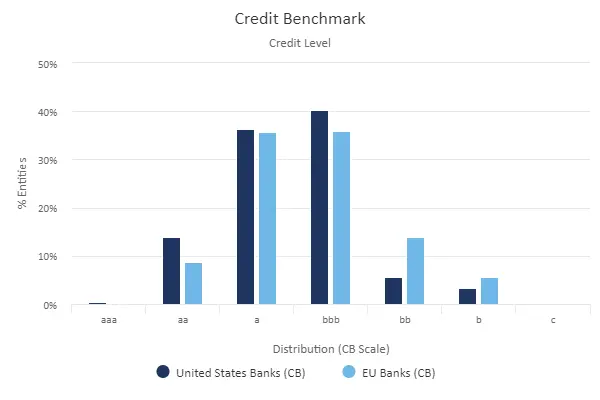

The below charts show credit distributions for 209 US and 374 EU banks, plus recent trends.

US and EU Banks: Credit Distribution

US Banks have higher proportions of Investment Grade consensus ratings across all credit categories.

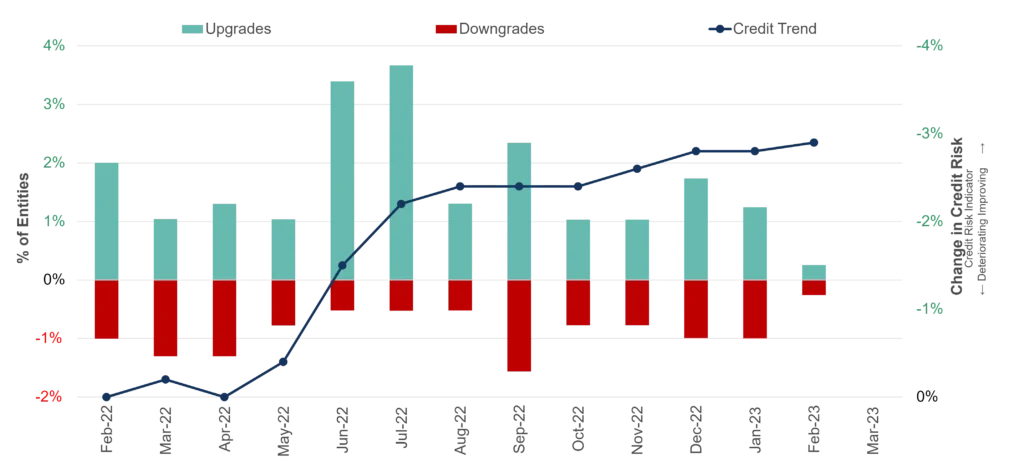

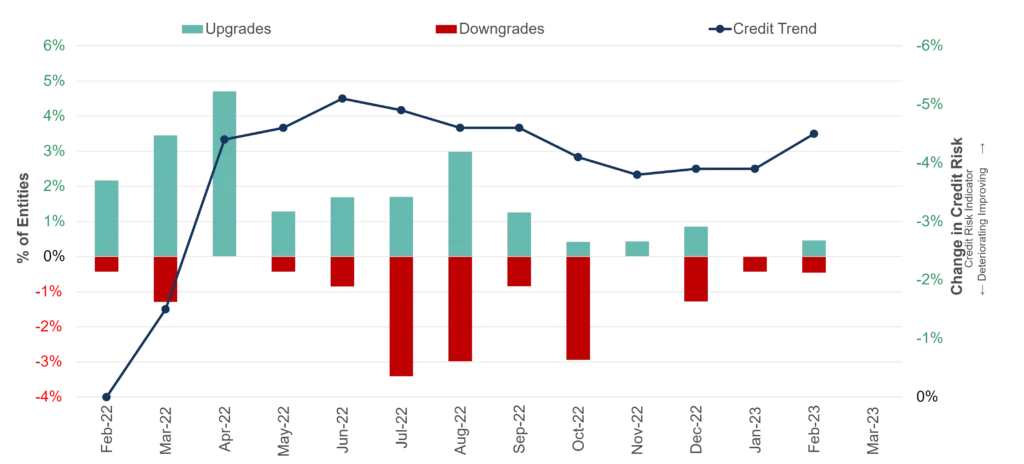

However, apart from last month’s uptick, average default risk in the US deteriorated for much of H2 2022 ahead of recent volatility. EU default risk has been steadily improving and recent months have favoured upgrades.

EU Banks: 12M Trend

US Banks: 12M Trend

Credit Benchmark data is updated every two weeks. End-February data flash update is now available.