Over the past 12 months, equity markets have steadily recovered from their panic-stricken lows in Q1 2020. Consensus credit has also adjusted, but changes in estimates of credit risk have been more measured and sometimes at odds with equity markets in particular. There are many cases where rising credit risk has been eclipsed by stellar equity performance.

Equity markets have been buoyed by Central Bank accommodation and Government support programmes, but this overall effect can be stripped out by looking at the relative performance of industries.

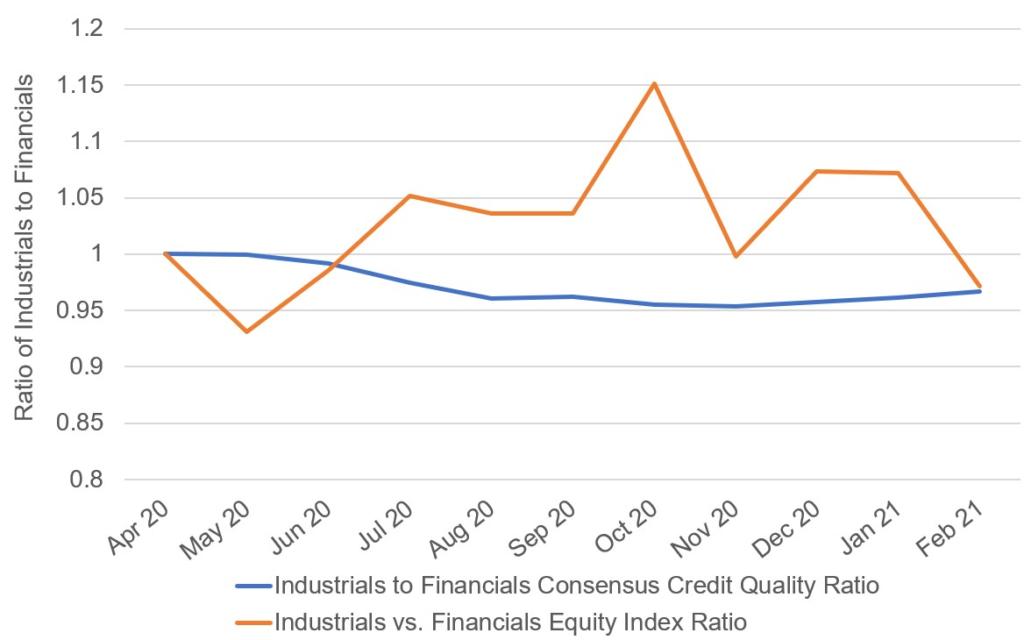

Figure 1 plots the equity and credit relative trends over the past year for the US Industrial and US Financial industries. The orange line shows the ratio of the equity indices (using the SPDR ETFs as proxies) for these two industries, while the blue line shows the inverted ratio of consensus credit risks for the same industries.

This shows that the relative equity performance has been volatile, reaching a minimum (Industrials underperforming Financials) of -7% in May 2020 and a maximum of +15% in October 2020. The ratio of credit risks has been much more subdued, varying by about 5% over the same period.

The two series are currently almost perfectly aligned, despite the relative equity ratio having covered considerably greater distance as markets have veered between favouring financials in the early phase of the crisis, moving into industrials during the summer, before shifting back to financials in recent months.

Credit trends have favoured financials over much of this period, although recent estimates have been more balanced.

As with previous comparisons (between consensus credit and bond indices), this chart suggests further scope to use consensus credit as a stable, “smart moving average” benchmark that indicates when markets are overbought or oversold. In this case, it turns out that the best approach was be increasingly long of industrials and short of financials as Q2 progressed, reversing that position as the gap between the two became increasingly stretched compared with the consensus credit benchmark.