Central Counterparty Clearing Houses (CCPs) have seen increased scrutiny in the wake of a massive $130 million default on the Nasdaq Commodities exchange in 2018. It was revealed that the default was caused by an individual Norwegian trader acting as a direct clearing member of Nasdaq. The European Securities and Markets Authority (ESMA) has since announced that it will consider enhancing supervisory practices for CCPs.

It is clear that CCPs lie at the epicenter of the global financial markets and that with the encouragement of global regulators they have consolidated and grown stronger since the global financial crisis. However, there is broad recognition from those in the CCP community that there is room for improvement in enhancing the security and performance of CCPs under severe stress.

This whitepaper examines the complex interconnected nature of the “CCP Network” – Central Counterparties, their clearing members, and the underlying clients of these members – and looks at the potential application of Consensus credit data to help bring transparency and alignment to the network.

The interconnectedness of the CCP Network is an integral part of the global financial system. It is critical to understand the creditworthiness of these nodes and how they interact, impact and potentially move and mitigate systemic risk.

In the paper, we look at some of the Consensus credit risk data available on the three distinct parts of the CCP network and how this data changes over time. These three parts are:

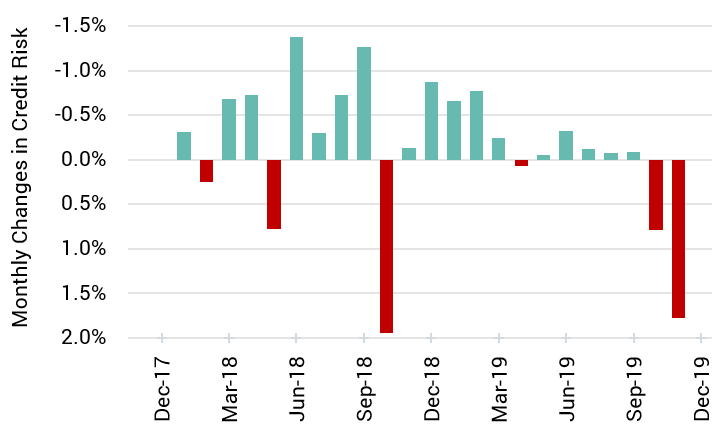

Credit Activity (29 CCPs)

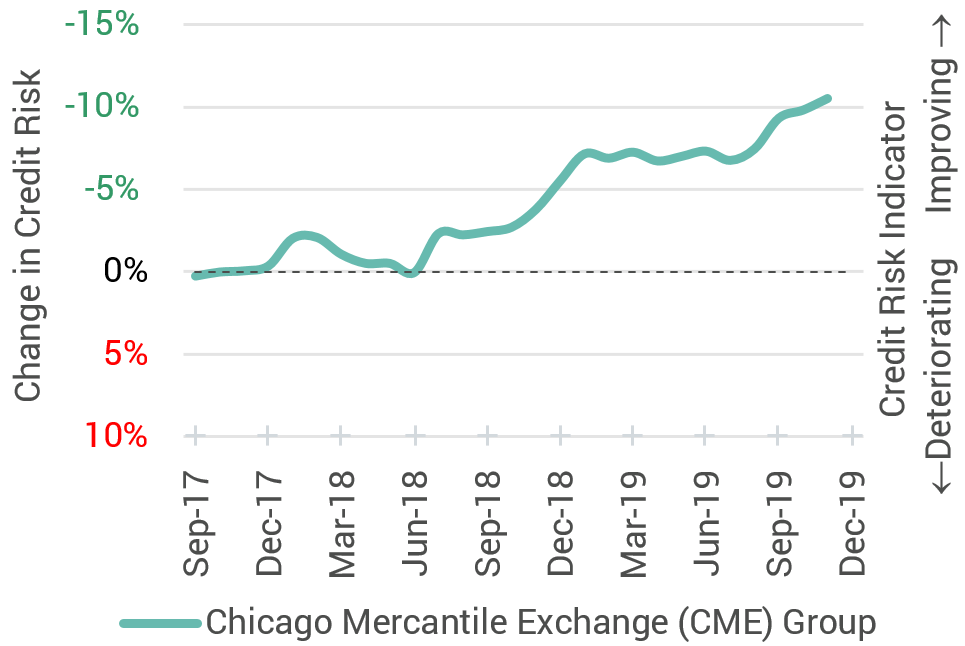

Credit Trend for 49 Clearing Members of CME Group

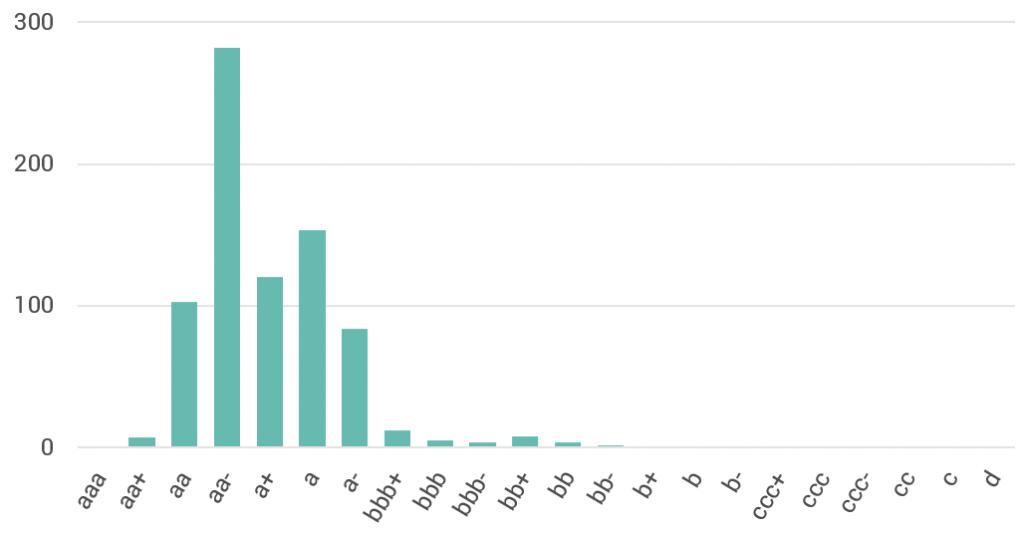

Credit Distribution of 1,118 Funds Under Management of BlackRock Inc

This paper aims to identify how Consensus credit data can play a role in helping participants assess the true risk level that they face, and how – collectively – the network participants can prevent potential triggers of CCP default waterfalls.

.