The four largest custodian banks[1] now provide safekeeping for more than $100trn of stocks and bonds – about two-thirds of the world’s listed assets. But to handle millions of day-to-day trade reconciliations and asset ownership changes in hundreds of markets, these global custodians use a growing network of sub-custodians around the world as representatives and asset repositories.

Delegating or sub-contracting custody creates a number of layers of operational and credit risks. These risks are low probability, but potentially high impact: the 2008 Lehman Brothers default left trails of damage and legal claims that are still not fully resolved.

COVID-19 has put a spotlight on the complex web of interconnections in the modern global economy. In the custody world, the network of sub-custodians represents multiple potential points of failure. As usual, the devil is in the detail. In theory there are important differences in asset security between, for example, a custody delegate and a custody subcontractor – but in practice the legal difference can be fuzzy.

The increasing complexity of these global sub-custodial networks means less clarity about where an asset is held – and the credit risk of the legal entity holding it. A new whitepaper by Credit Benchmark maps this interconnectivity and sheds light on hidden potential credit risks within these networks.

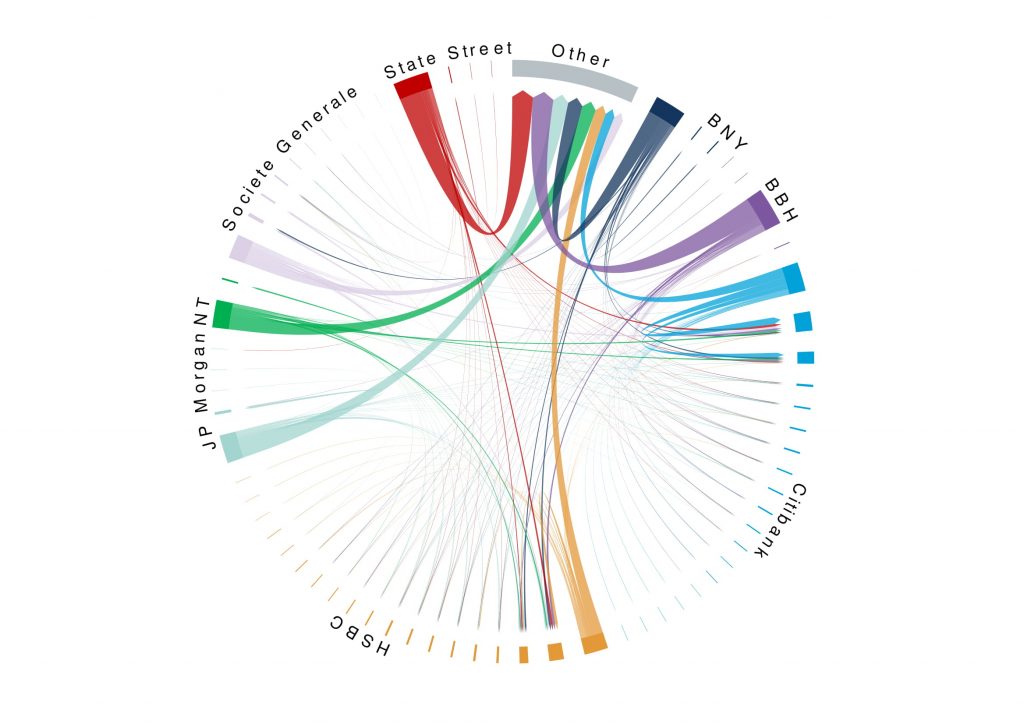

The chart below shows the interconnectivity of some of the major sub-custodian networks.

While Citibank and HSBC use their own subsidiaries for 58% and 40% of their sub-custodial relationships respectively, the chart shows that other custodians are far more likely to turn to the services of external sub-custodians. Brown Brothers Harriman and State Street use their own sub-custodians in less than 5% of their relationships.

Public credit rating information on the sub-custodians within these networks is by no means comprehensive. Only 38% of Citibank’s chosen sub-custodians are rated by the main credit rating agencies (CRAs). Credit Benchmark’s Consensus credit data, sourced from over 40 of the world’s leading financial institutions, provides a Consensus rating on 88% of Citibank’s sub-custodial network, and on between 85-99% of the other largest custodians’ networks.

Asset managers have a fiduciary duty to their beneficial owners to understand where an asset may be held within their chosen custodian’s network. They need to consider if they are willing to entrust some of those assets to institutions that may not meet their usual credit criteria. If a sub-custodian defaults, the asset could become temporarily inaccessible or even frozen indefinitely, with financial fallout ranging from opportunity costs to material losses.

Credit Benchmark can help measure, monitor and manage the credit risk that asset owners are exposed to through their custodial networks.

[1] Bank of New York Mellon, State Street, Citibank, JP Morgan Chase