The COVID-19 pandemic has not been kind to global airline credit quality. As of February 2021, a total of 21 major global airlines have been downgraded to high yield (HY) status since the start of the pandemic, according to Credit Benchmark data. But that grim statistic does not tell the full story. A handful of airlines are starting to see their credit quality improve and two in particular – Singapore Airlines and Ryanair – have recently been upgraded and are sitting squarely in investment grade (IG) territory.

Singapore Airlines currently has a Credit Consensus Rating (CCR) in the range of a to aaa and Ryanair has a CCR in the range of bbb to a-.

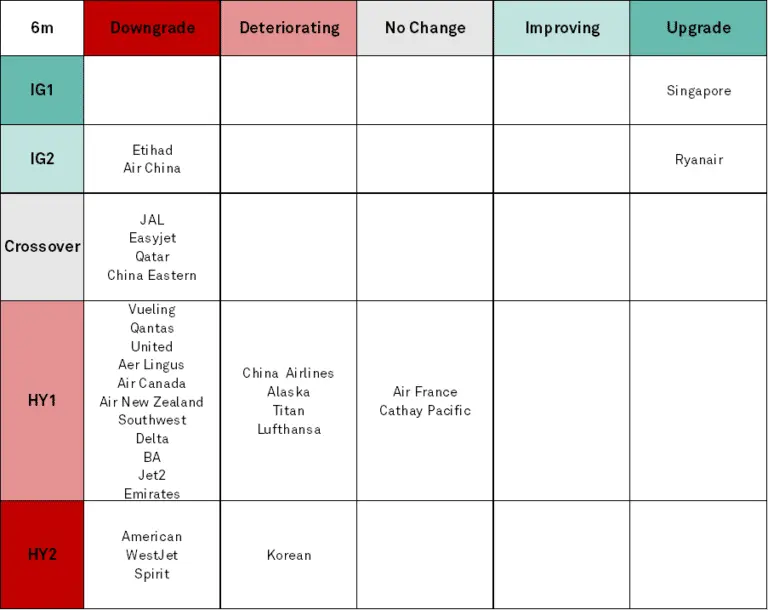

In the quadrant below, Credit Benchmark has mapped the credit risk profiles for the major global airlines over the past 6 months, spotlighting those who have recently been upgraded, those who are at risk of downgrade and those who are hovering in the middle.

Global Airline Credit