Credit Default Swap (“CDS”) prices are often cited as a proxy for solvency risk. When CDS are not available, consensus credit estimates can be a robust alternative – provided they are adjusted by the market risk premium.

GSIBs[1] are the most scrutinised financials in the world. From a solvency perspective, regulators and investors are as well informed about these firms as it is possible to be. So CDS for these companies should be highly liquid and CDS prices should be an accurate reflection of the collective market view of the risk of default across these key banks – with the addition of the prevailing market risk premium.

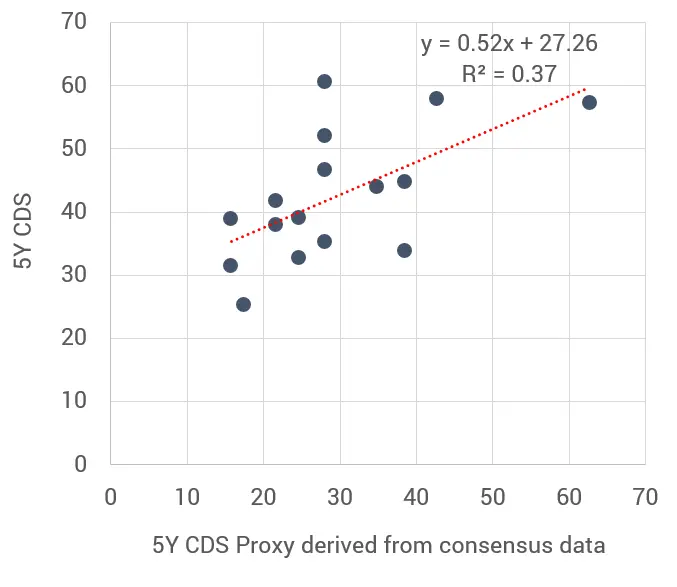

Figure 1 compares actual CDS prices with proxies[2] based on consensus credit risk estimates for 16 of the GSIBs.

There is a moderately positive relationship, but there are clearly some large variations. The lowest CDS price is 26 Bps; the proxy estimate using consensus data for the same bank is 17 Bps. The highest proxy is 62 Bps against an actual CDS price of 58 Bps. But for the highest CDS price – 61 Bps – the proxy is about half that level, at 28 Bps[3]. So even for the most publicly scrutinised financial firms in the world, markets and banks themselves are not in complete agreement about solvency risk.

The fitted line gives an estimate of the basic risk premium (the fitted intercept) of 27 Bps. The fitted slope shows that for every 2 Bps increase in the proxy, there is an implied 1 Bps increase in the CDS price on top of this base level.

This combination of consensus credit risk estimates with CDS prices allows capital market participants to estimate the current risk premium for any group of firms where liquid CDS are trading. Where no CDS exists, consensus data can be combined with risk premium estimates to assess fair values for Trade Credit Insurance contracts.

The current market environment has thrown up many apparent and potentially tradeable anomalies such as those outlined here. With consensus data now also available on Bloomberg, market practitioners can make detailed comparisons between real world default risks and CDS, Bond and Equity prices for large groups of issuers. Premium users have access to issuer solvency risk indicators and analytics in up to 100 categories.

Learn more about Credit Benchmark Premium Data and Analytics

Please complete the form below and someone from the Credit Benchmark team will be in touch soon

[1] GSIBs = Global Systemically Important Banks. See https://www.bis.org/bcbs/gsib/. Current list covers 40 banks.

[2] Recovery rate assumed = 40%; One year consensus PD converted to five year using survival rate compounding.

[3] This anomaly may be due to abnormal costs of hedging CDS positions linked to this bank’s reference bond. Or the recovery rate assumption may be inappropriate; or the survival rate approach used to transform a 1-year risk estimate into a 5-year risk estimate may – in this case – be too simplistic.