The retail sector is enjoying some long-awaited good fortune. According to the latest consensus data, credit risk has improved for both the US and UK retail sectors. It’s a welcome change of pace for an industry which was thrown for a loop during the pandemic. Even better, the forecast continues to look promising for each sector as their respective economies improve and vaccination rates continue to trend higher.

The recently announced effort by the Biden administration to mandate or encourage vaccinations will likely push figures up in the US; Goldman Sachs estimates an additional 12 million vaccinations will result from this effort. Private employers mandating the vaccine will push this total even higher. Plus, monetary policy will remain accommodative for the near future, even with some tapering.

Credit risk remains higher than it was at the start of the pandemic, especially for the UK, and future pandemic flare ups could certainly curtail future improvements. But for now, things are looking up for US and UK retail.

US retail continues on a slow and steady path to improvement. Credit quality is down 9% year-over-year, but the latest The outlook for US retail continues to brighten. Credit quality has improved 2% month-over-month, 11% from six months ago, and 8% from the same point last year. Default risk is currently 58 bps, compared to 59 bps last month, 65 bps six months ago, and 63 bps at the same point last year. The sector’s overall CCR rating is bb+ and 79% of firms are at bbb or lower. Overall US corporate default risk is 62 bps, with a CCR of bb+ and 80% of firms at bbb or lower.

The position for UK retail is also improving. Credit quality is still down 4% year-over year, but it’s improved 2% from last month and 7% from six months ago. Default risk is now 96 bps, compared to 98 bps last month, 103 bps six months ago, and 93 bps at the same point last year. The sector’s overall CCR rating is bb and 92% of firms are at bbb or lower. Overall UK corporate default risk is 80 bps, with a CCR of bb and 90% of firms at bbb or lower.

About Credit Benchmark Monthly Retail Aggregate

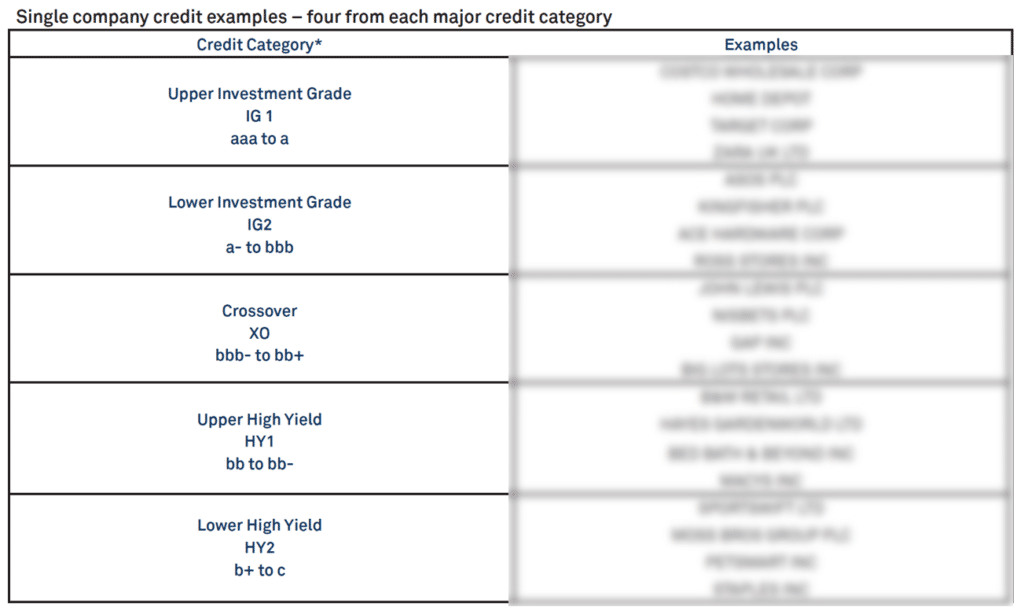

This monthly index reflects the aggregate credit risk for US and UK General Retailers. It illustrates the average probability of default for companies in the sector to achieve a comprehensive view of how sector risk will be impacted by trends in the retail industry. A rising probability of default indicates worsening credit risk; a decreasing probability of default indicates improving credit risk. The Credit Consensus Rating (CCR) is a 21-category scale explicitly linked to probability of default estimates sourced from major financial institutions. The letter grades range from aaa to d.

Credit Benchmark brings together internal credit risk views from 40+ of the world’s leading financial institutions. The contributions are anonymized, aggregated, and published in the form of entity-level consensus ratings and aggregate analytics to provide an independent, real-world perspective of risk. Consensus ratings are available for 60,000 financials, corporate, funds, and sovereign entities globally across emerging and developed markets, and 90% of the entities covered are otherwise unrated.