.

The outlook for major energy sectors ranges from good to under-performing. The US energy sector is seeing improvement in its credit though with a small blip this month. Meanwhile, the UK has seen slight improvement, and the EU has seen slight deterioration.

The industry is not without its challenges – losses from Hurricane Ida in the US were the worst since 2005, and additional hurricanes could cause further trouble. Meanwhile, wholesale gas prices are surging in the EU and UK which could lead to a host of problems including more insolvencies and a spill over effect on other industries.

The UK is also in the midst of a fuel crisis, after disclosures that a nationwide shortage of HGV drivers had disrupted supply to some petrol stations, though major suppliers have assured consumers that UK fuel stocks are plentiful and the situation is expected to soon return to normal.

Additionally, the threat from the pandemic, while greatly reduced, has not gone away entirely. The months ahead threaten to be perilous.

.

The US energy sector continues to look more positive. The latest data show credit quality down 5% year-over-year but improving 7% over the last months and remaining largely unchanged from last month. Default risk is now 67 bps, compared to 72 bps six months ago and 64 bps at the same point last year. Now this sector’s overall CCR rating is bb+ and 85% of firms are at bbb or lower. Overall Large US Corporate default risk is 52 bps, with a CCR of bb+ and 78% of firms at bbb or lower.

The UK energy sector has received some breathing room. Credit quality is down 13% year-over-year and 4% over the last six months but has improved 1% compared to last month. Default risk is 49 bps, compared to 47 bps six months ago and 43 bps at the same point last year. Now this sector’s overall CCR rating is bb+ and 75% of firms are at bbb or lower. Overall Large UK Corporate default risk is 63 bps, with a CCR of bb+ and 86% of firms at bbb or lower.

The overall position for the EU energy sector is largely stable. Credit quality is down 1% from last month but has improved 1% over the last six months. From the same point last year, it’s down 7%. Default risk is 33 bps, compared to 32 bps last month, 33 bps six months ago, and 31 bps at the same point last year. This sector’s overall CCR rating is bbb and 73% of firms are at bbb or lower. Overall Large EU Corporate default risk is 34 bps, with a CCR of bbb- and 73% of firms at bbb or lower.

.

About The Credit Benchmark Monthly Oil & Gas Aggregate

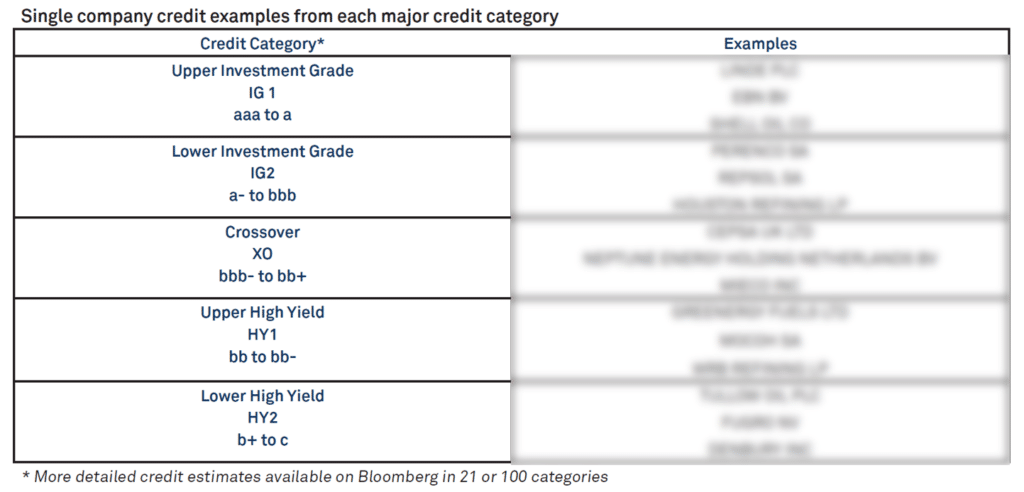

This monthly index reflects the aggregate credit risk for large US, UK, and EU firms in the oil & gas sector. It provides the average probability of default for oil & gas firms over time to illustrate the impact of industry trends on credit risk. A rising probability of default indicates worsening credit risk; a decreasing probability of default indicates improving credit risk. The Credit Consensus Rating (CCR) is a 21-category scale explicitly linked to probability of default estimates sourced from major financial institutions. The letter grades range from aaa to d.