The Basel Committee on Banking Supervision is proposing significant changes to the use of internal risk models by IRB banks, and the final date for industry responses is the end of this week. A copy of the press release and paper can be found here

One proposal which could have a significant impact beyond the global banking industry is the increased use of market-implied credit risk measures for RWA calculations.

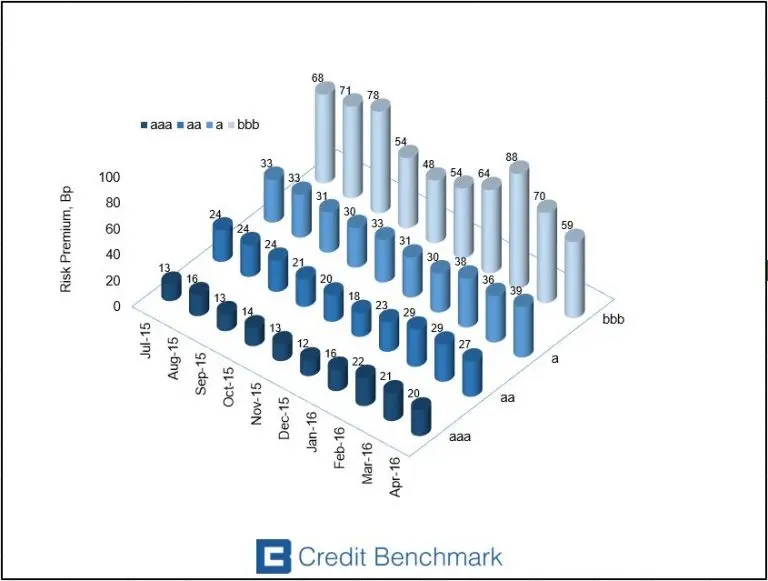

The following chart shows those risk premiums for investment grade CBC-7* categories, derived from Sovereign CDS markets and Credit Benchmark data. This shows that the risk premium varies significantly over time and by credit quality.

These risk premiums can be used by a financial institution in two possible ways:

- Modify RWA to be consistent with real world PDs, which will usually lead to more efficient use of capital.

- Provide market-consistent prices for a large range of bonds and CDS which have been issued, but are not currently trading.

Further research is underway to test whether Corporate and Financial risk premiums follow similar patterns.

*CBC-7 = Credit Benchmark Consensus using a 7-category scale which is explicitly linked to probability of default estimates sourced from major banks. A CBC-7 of aa is broadly comparable with AA in the 7-category scales from S&P, Moody’s and Fitch.