COVID-19 has caused major economic damage, especially in sectors connected with travel and leisure. But in manufacturing and technology there will be some strong winners: increased factory automation, major house-building and property conversion programs, increased demand for private cars, new software to facilitate social distancing in a broad range of situations, and major supply chain restructuring.

The most recent Consensus credit data gives some insight into how these winners are already emerging.

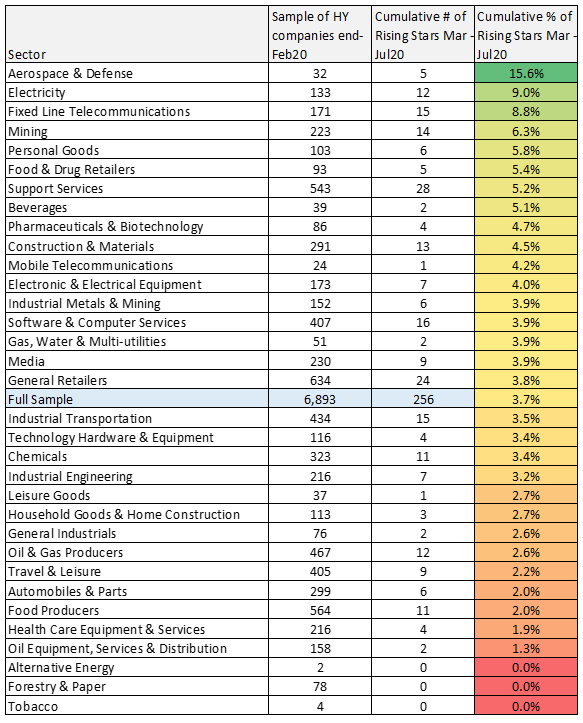

Figure 1 shows the proportion of Global Corporate companies that were in Non-Investment Grade credit categories in February 2020 and are now viewed as Investment Grade.

The overall rate is 3.7% – less than half of the “Fallen Angel” rate. Top of the list is Aerospace and Defense with a rate of 15.6%; followed by Electricity (9%) and Fixed Line Telecommunications (8.8%). Mining, Personal Goods, Food & Drug Retailers, Support Services and Beverages are all above 5%. Construction & Materials (4.5%), and Software & Computer Services (3.9%) are also positive.

The bottom of the list includes Tobacco, Forestry & Paper, Alternative Energy, Oil Equipment, Health Care Equipment, Food Producers and Automobiles & Parts.

Some of these may seem surprising, but the position of each sector in this list is partly determined by the proportion of companies that are already Non-Investment grade. Health Care Equipment, for example, is heavily skewed towards Investment Grade.

Aerospace and Defense is dominated by companies in the bbb category, with equal proportions on either side in the stronger and weaker credit categories. Many airlines are in the process of converting their passenger aircraft to carry freight, which along with financial assistance in the form of government bailouts, may partly explain the strong improvement in some companies in an otherwise badly-hit sector.

Construction & Materials is dominated by companies in the bb category, and very few that are better than a. The trend towards upgrades is likely to continue over the next 12 months with the need for new infrastructure adding to the impact of Government stimulus packages.