Retail sales may be rising, even if the pace in August was lower than anticipated, but retailers themselves continue to struggle. The number of store closings in the US has remained higher than openings most weeks, bankruptcies are at a notable high and there’s potential for more in the months ahead, including many well-known brands. The plight of UK retailers was similar in September. The situation looked better in October, but the British Retail Consortium warned the relief may not last. The hits to each country have been staggering. There are calls for more stimulus in the UK. In both the US and UK, retail sales will be limited until more restrictions can be lifted and the economies of each country improve.

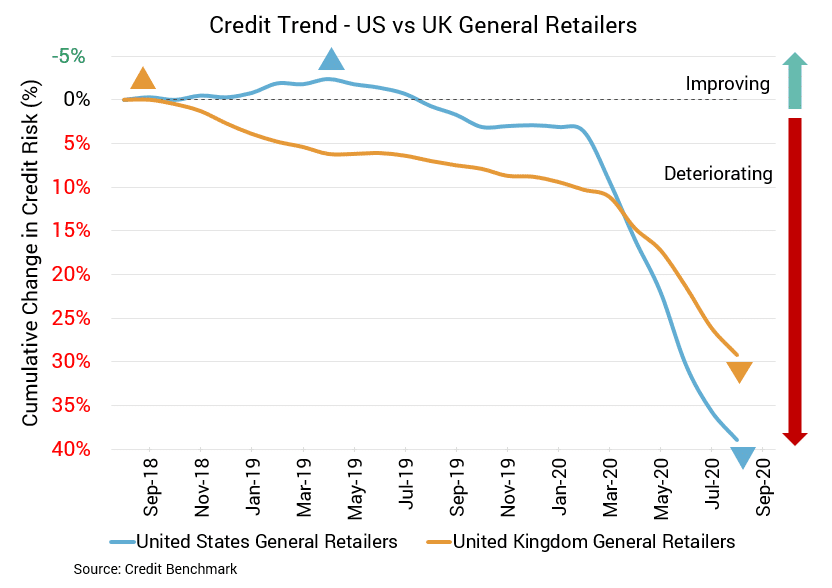

The downwards trajectory of credit quality for the US retail sector over the last year has been relentless. Each month brings a new drop in credit quality and an increase in default risk. Compared to the last update, credit quality has dropped by approximately 2%. It’s down about 7% from two months prior, about 14% from three months prior, and about 34% from six months prior. Year over-year, credit quality has fallen by around 38%. Average probability of default is now approximately 58 bps, compared to about 57 bps in the prior update. It was about 55 bps two months prior, about 51 bps three months prior, and about 43 bps six months prior. At the same point last year, it was around 42 bps. The current overall CBC rating for this aggregate is bb+, with about 78% of firms at a CBC rating of bbb or lower.

The UK retail sector has followed a similar trajectory. With the most recent update, credit quality has dipped by approximately 2%. It has fallen by about 6% from two months prior, about 10% from three months prior, and about 17% from six months prior. Credit quality has dropped by around 21% year-over-year. Average probability of default is now approximately 83 bps. It was about 81 bps in the prior update, and about 78 bps two months prior, about 75 bps three months prior, and about 71 bps six months prior. It was about 69 bps at the same point last year. The overall CBC rating for this aggregate is still bb, with about 92% firms at a CBC rating of bbb or lower.

About Credit Benchmark Monthly Retail Aggregate

This monthly index reflects the aggregate credit risk for US and UK General Retailers. It illustrates the average probability of default for companies in the sector to achieve a comprehensive view of how sector risk will be impacted by trends in the retail industry. A rising probability of default indicates worsening credit risk; a decreasing probability of default indicates improving credit risk. The Credit Benchmark Consensus (CBC) Rating is a 21-category scale explicitly linked to probability of default estimates sourced from major financial institutions. The letter grades range from aaa to d.

Credit Benchmark brings together internal credit risk views from 40+ of the world’s leading financial institutions. The contributions are anonymized, aggregated, and published in the form of entity-level consensus ratings and aggregate analytics to provide an independent, real-world perspective of risk. Consensus ratings are available for 50,000+ financials, corporate, funds, and sovereign entities globally across emerging and developed markets, and 75% of the entities covered are otherwise unrated.