Credit Benchmark have released the October Credit Consensus Indicators (CCIs). The CCI is an index of forward-looking credit opinions for US, UK and EU Industrials based on the consensus views of over 20,000 credit analysts at 40 of the world’s leading financial institutions.

Drawn from more than 800,000 contributed credit observations, the CCI tracks the total number of upgrades and downgrades made each month by credit analysts to chart the long-term trend in analyst sentiment for industrials. A monthly CCI score of 50 indicates neutral credit quality, with an equal number of upgrades and downgrades made over the course of a month. Scores above 50 indicate that credit quality is improving. Scores below 50 indicate that credit quality is deteriorating.

The October CCIs show prolonged credit deterioration for UK, EU and US Industrial companies, though there are signs that the severity is lessening.

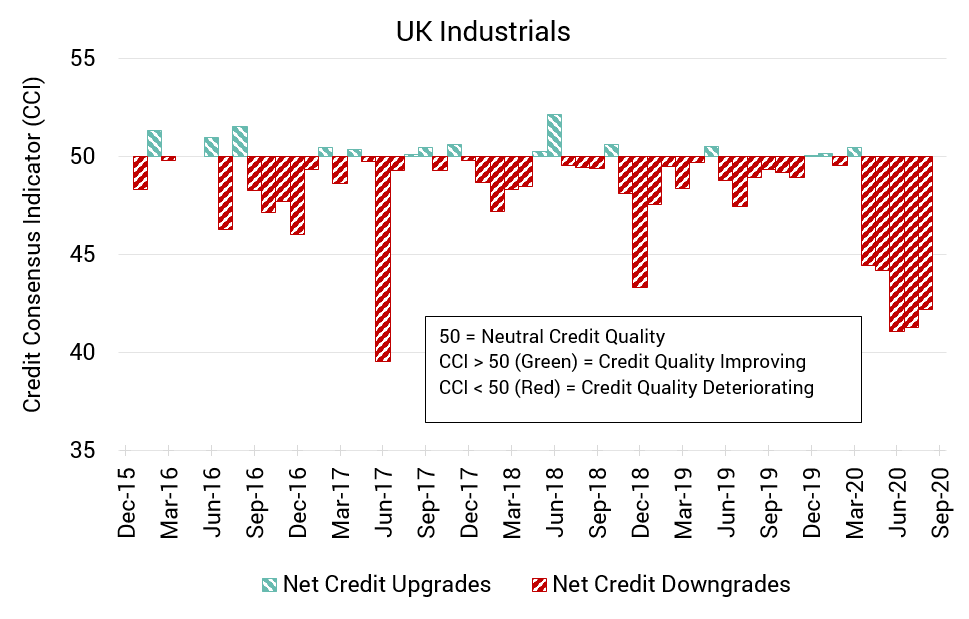

UK Industrials: Little Variation Seen in Negative Trend

UK Industrial companies have continued to deteriorate for a fifth successive month, and with little recent variation in the severity of the deterioration.

The CCI for this month sits at 42.2; a minimal improvement from last month’s CCI of 41.3.

Output for the UK is still 9% below pre-pandemic levels and the spectre of a second full lockdown hangs over the economy. As the outlook continues to deteriorate there is an increasingly heated debate about the timing and scale of further stimulus packages.

.

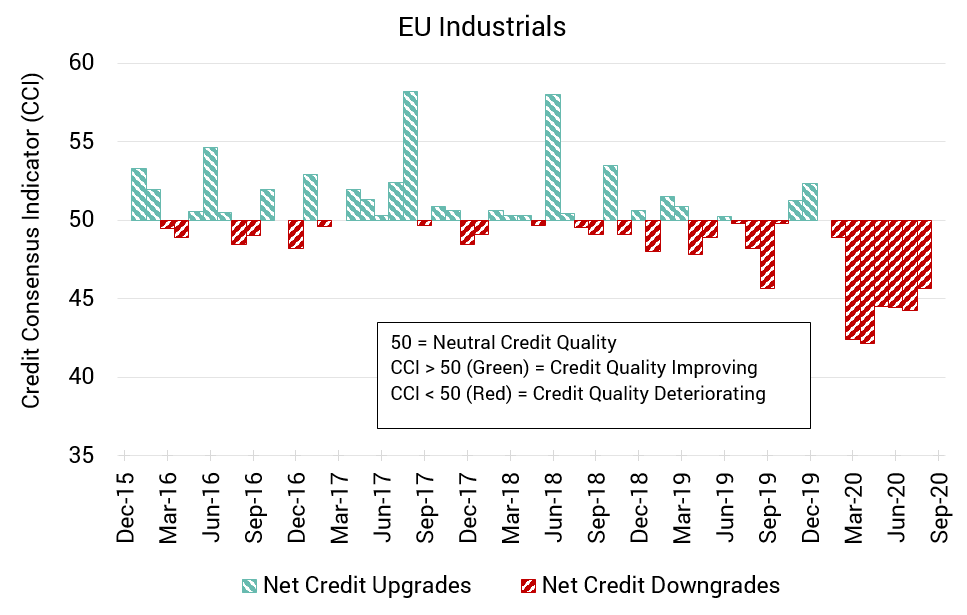

EU Industrials: Downgrades Persist but Severity Lessens

Although EU Industrial companies have shown net deterioration for the past seven months, the severity of the trend is gradually lessening.

This month’s CCI is 45.7, an improvement from last month’s CCI of 44.2, and the comparatively best position since February 2020.

Emergency measures taken by Eurozone governments to counter coronavirus amount to a potential budget deficit of almost €1tn – a powerful short term boost but increases concerns about longer-term sovereign debt challenges.

.

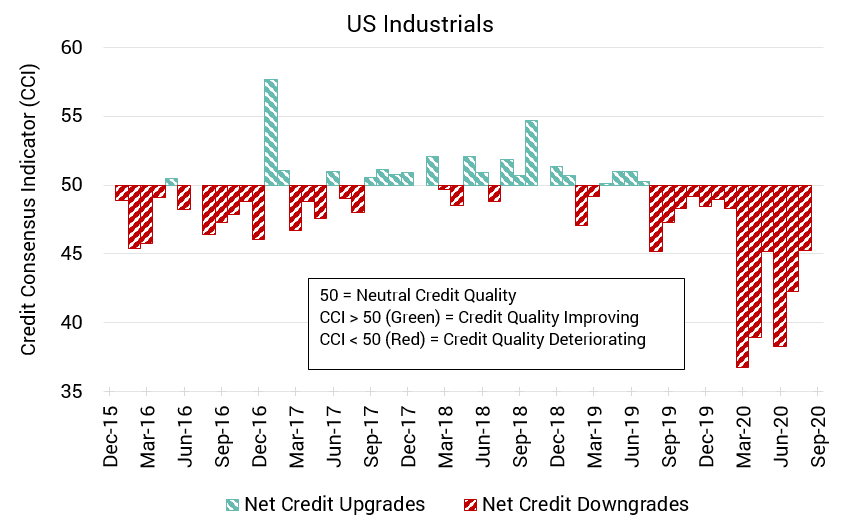

US Industrials: Downgrades Dominate but Trend Is Moving in the Right Direction

The deep drops in credit quality observed over recent months for US Industrials are easing, though the CCI still remains firmly in the red.

This month, the CCI sits at 45.3, a modest improvement from last month’s CCI of 42.3. The CCI is comparatively in its best position since February 2020.

US manufacturing dropped by 0.3% in September after earlier increases – suggesting a possible ‘tea kettle’ shaped recovery?

.

To download the full CCI tear sheets for UK, EU, and US Industrials, please enter your details below: