Credit Benchmark have released the May Credit Consensus Indicators (CCIs). The CCI is an index of forward-looking credit opinions for US, UK and EU Industrials based on the consensus views of over 20,000 credit analysts at 40 of the world’s leading financial institutions.

Drawn from more than 800,000 contributed credit observations, the CCI tracks the total number of upgrades and downgrades made each month by credit analysts to chart the long-term trend in analyst sentiment for industrials. A monthly CCI score of 50 indicates neutral credit quality, with an equal number of upgrades and downgrades made over the course of a month. Scores above 50 indicate that credit quality is improving. Scores below 50 indicate that credit quality is deteriorating.

The May CCIs have seen a dramatic surge of credit deterioration in EU and US industrial companies, while UK companies have been comparatively spared this month.

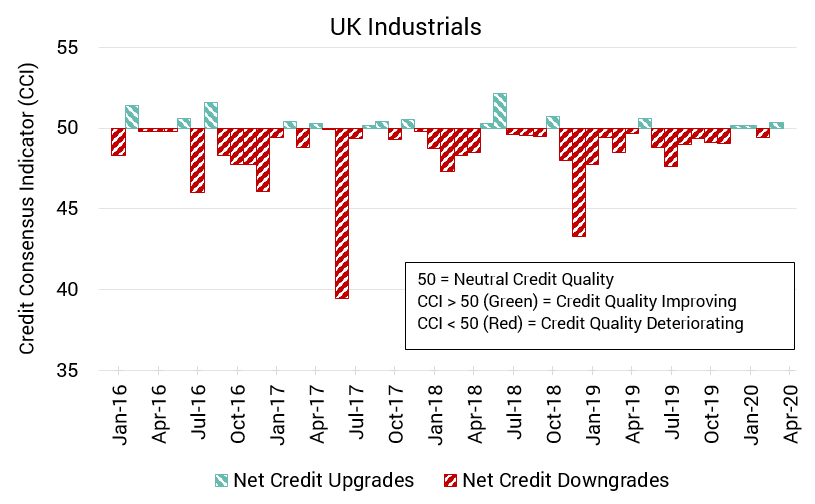

The UK Industrials CCI for May is 50.4; Credit Risk Continues to Toe the Line

UK Industrial companies have seen a slight reprieve from last month’s net downgrades but continue to hover near neutral.

The CCI for this month sits at 50.4; slipping back into positive territory after last month’s CCI of 49.4.

The last six months have seen three of net improvement and three of net deterioration, and no one month has dropped below a CCI of 49 or risen above 51. Recent growth in Health and Food manufacturing may be helping to keep the group afloat – or possibly earlier Brexit-related deteriorations mean there is little remaining ground to lose.

.

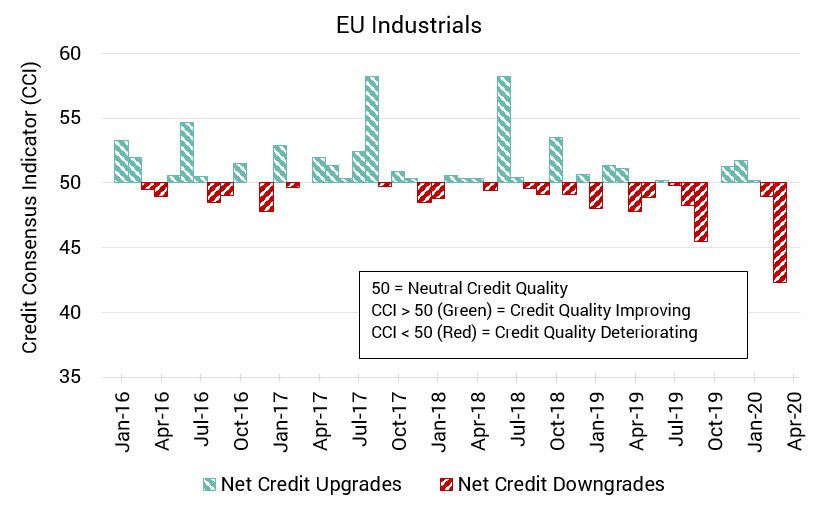

The EU Industrials CCI for May is 42.3; Net Downgrades Rise Sharply

EU Industrials have compounded last month’s swing towards downgrades with a significant further drop.

This month, the CCI for the region’s industrial companies is 42.3, following last month’s CC of 48.9.

A forecast given by Germany’s DIHK chambers of industry and commerce expects the national economy to shrink by at least 10% this year due to COVID-19, and industrial companies are reportedly facing massive liquidity problems. Industrial production across the EU dropped by 10.4% in March 2020.

.

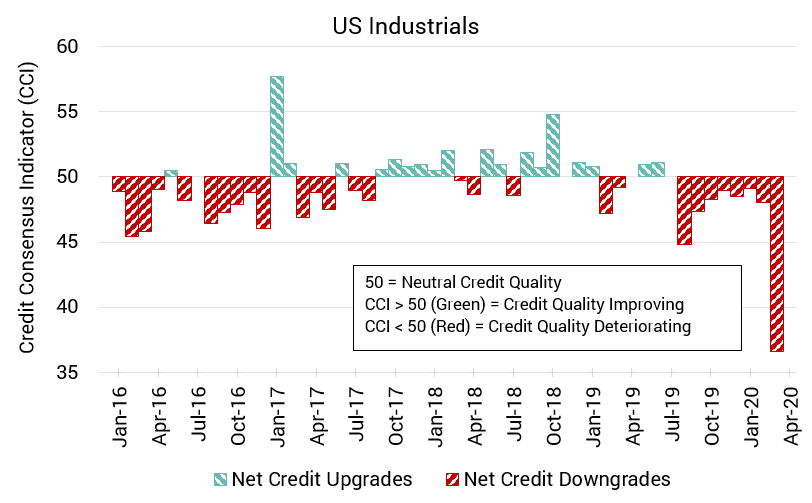

The US Industrials CCI for May is 36.6; CCI Paints Worrying Picture for US Industrial Credit Health

US Industrial companies have seen the largest recorded instance of net deterioration since CCI records began in December 2015.

The CCI for US firms has fallen to 36.6 this month from its previous position of 48. The CCI has trended towards deterioration for eight consecutive months now.

Manufacturing output plummeted by 13.7% in April according to the Federal Reserve, stoking fears that the US economy will contract at a pace not seen since the Great Depression. Fiat Chrysler Automobiles announced the return of 12,000 manufacturing staff on the 18th May which may prompt some recovery in future months.

.

To download the full CCI tear sheets for UK, EU, and US Industrials, please enter your details below: