The global automotive industry has felt the immediate impact of the COVID-19 economic slump, with factories across the world halting production or being hamstrung by supply-chain disruptions, whilst consumer demand rapidly shrinks.

US auto sales are expected to fall by at least 15% this year, and a reported 95% of all US auto production has been shut down as a result of the virus.

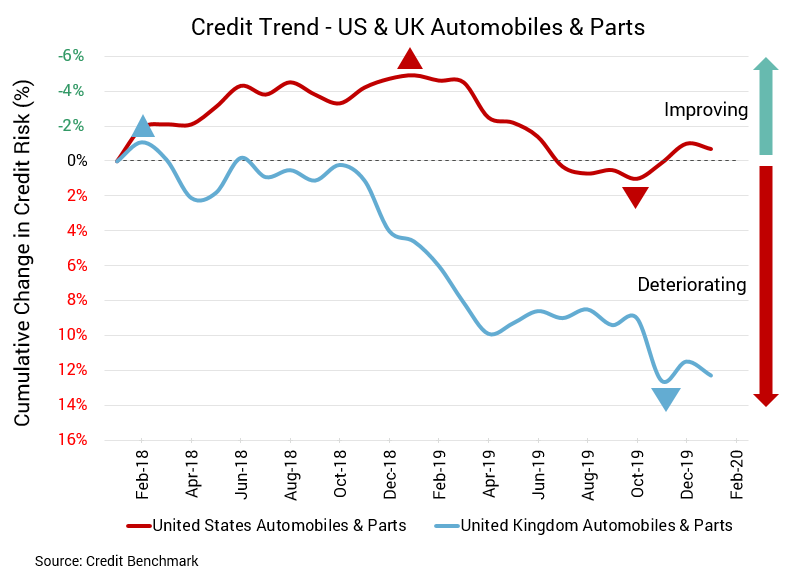

This slump is reflected in Credit Benchmark’s latest consensus data, with US and UK auto companies both reverting to credit deterioration after a recent brief respite.

The recent improvement in credit quality for US auto firms was short-lived. Credit quality for US auto sector firms has worsened by 0.4% from the prior month and by 4.5% from the same point last year. Average probability of default for these firms is 36.7 basis points, compared to 36.5 basis points the prior month and 35.1 basis points at the same point last year. The current Credit Benchmark (CBC) rating for this sector is bbb-, unchanged for the last 12 months.

Following last month’s update indicating improvement in UK auto industry credit quality, this month’s reading shows deterioration. Credit quality for UK auto sector firms has declined by 0.7% from the prior month and by 7.5% from the same point last year. Probability of default for these firms is 57.2 basis points, compared to 57.3 basis points the prior month and 53.8 basis points at the same point last year. The current Credit Benchmark (CBC) rating for this sector is bb+ and has not changed for the last 12 months.

About Credit Benchmark Monthly Auto Industry Aggregate

This monthly index reflects the aggregate credit risk for US and UK firms in the automobile and auto parts sectors. It illustrates the average probability of default for auto firms as well as parts suppliers to achieve a comprehensive view of how sector risk will be impacted by trends in the auto industry. A rising probability of default indicates worsening credit risk; a decreasing probability of default indicates improving credit risk. The Credit Benchmark Consensus (CBC) Rating is a 21-category scale explicitly linked to probability of default estimates sourced from major financial institutions. The letter grades range from aaa to d.