Credit Benchmark has published the latest monthly credit consensus data (from May 2017), with 14 contributor banks now providing bank-sourced credit views (CBCs*) on more than 10,300 separate legal entities over the past 12 months.

Sovereign coverage now includes Government of Saint Kitts and Nevis .

Additions to the data include Snap Inc, Fossil Group Inc, United Natural Foods Inc, Coca Cola Enterprises Inc, Syngenta AG, Sunwing Airlines Inc, Paddy Power Betfair Plc, NASDAQ Clearing AB, Interactive Brokers LLC, and Deutsche Asset Management Investment.

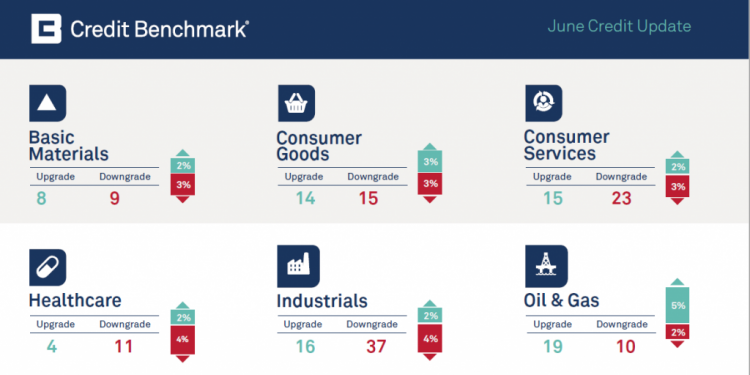

Monthly consensus upgrades and downgrades:

This compares with the previous month which showed improved consensus across 209 obligors and decreased consensus across 282. Amongst those obligors that saw movement, 56 moved by more than one notch.

Industries:

*CBC = Credit Benchmark Consensus; a 21-category scale which is explicitly linked to probability of default estimates sourced from major banks. A CBC of bbb+ is broadly comparable with BBB+ from S&P and Fitch or Baa1 from Moody’s.

**Quorate = Quorate PDs are those derived from three or more Probability of Default estimates for the same legal entity. This “rule of three” is similar to that used for bond prices by Bloomberg, and CDS prices by IHS-Markit. It is intended to preserve contributor anonymity by preventing scope for reverse engineering.

Disclaimer: Credit Benchmark does not solicit any action based upon this report, which is not to be construed as an invitation to buy or sell any security or financial instrument. This report is not intended to provide personal investment advice and it does not take into account the investment objectives, financial situation and the particular needs of a particular person who may read this report.