As the clock struck midnight and 2020 came to a close, the words of ‘Auld Lang Syne’ may have rung hollow for the millions living through another lockdown in the United Kingdom. The tradition of bidding farewell to the old year and welcoming new beginnings seemed like wishful thinking amidst a fresh surge of COVID infection rates and the prolonged economic strangulation of many British businesses.

With the vaccination program picking up pace, Brits may look forward to the prospect of a European summer break or at the least, a drink in the local pub. However, the likelihood of that package holiday firm or the favourite ‘local’ staying afloat long enough to meet post-pandemic demand remains in question. The government’s furlough scheme is due to wrap up at the end of April, and the Bank of England’s Covid Corporate Financing Facility (CCFF) closes in late March, leaving the future of many British businesses uncertain as they grapple with a year’s worth of debt and minimal incomings.

Credit Benchmark collects internal credit risk estimates from global financial institutions, providing forward looking tracking of changes in the credit risk of existing borrowers and of the impact on the portfolios of the contributing financial institutions.

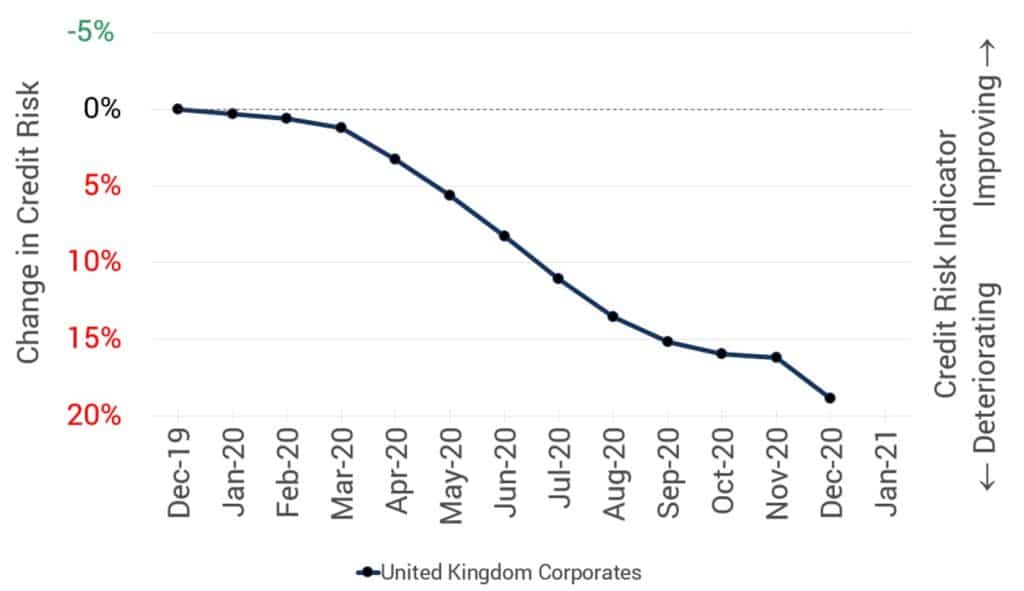

The data, covering more than 5,000 UK Corporates, show that the average one-year default probability of UK Corporate has risen to 0.67%. In effect, financial institutions expect 1 in 150 corporates to default over the next year. As shown in Figure 1, this represents a 19% higher chance of defaulting compared to a year ago, with Consumer Services and Oil & Gas the most impacted industries. The steepest increase in credit risk was observed between April and August with an average monthly growth rate of 2.4%. The latter months of the year show a stabilization, with credit risk growing only by 0.2% in November. But the third COVID wave brought another steep increase in credit risk in December [please continue below to access full report].