Credit Benchmark have released the July Credit Consensus Indicators (CCIs). The CCI is an index of forward-looking credit opinions for US, UK and EU Industrials based on the consensus views of over 20,000 credit analysts at 40 of the world’s leading financial institutions.

Drawn from more than 800,000 contributed credit observations, the CCI tracks the total number of upgrades and downgrades made each month by credit analysts to chart the long-term trend in analyst sentiment for industrials. A monthly CCI score of 50 indicates neutral credit quality, with an equal number of upgrades and downgrades made over the course of a month. Scores above 50 indicate that credit quality is improving. Scores below 50 indicate that credit quality is deteriorating.

The July CCIs have seen continued credit deterioration for UK, EU and US Industrial companies.

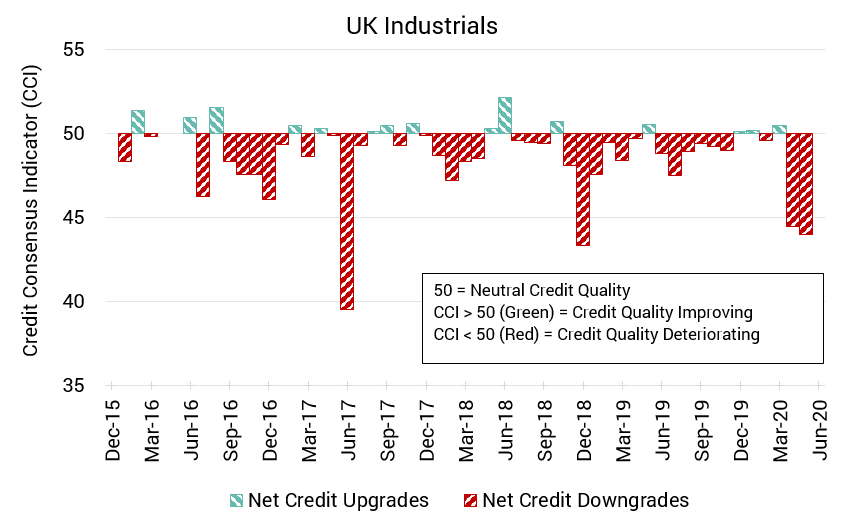

UK Industrials: CCI Shows Further Deterioration

Last month’s swing from near-neutral credit quality to pronounced deterioration for UK Industrial companies continued for a second month in similar severity.

The CCI for this month is 44, a very slight worsening from last month’s CCI of 44.4.

Recent output figures indicated that industrial manufacturing and production in the UK improved from April to May against expectations. UK businesses must contend with the dual threats of COVID-19 and the approaching end of the Brexit transitionary period with no deal yet confirmed

.

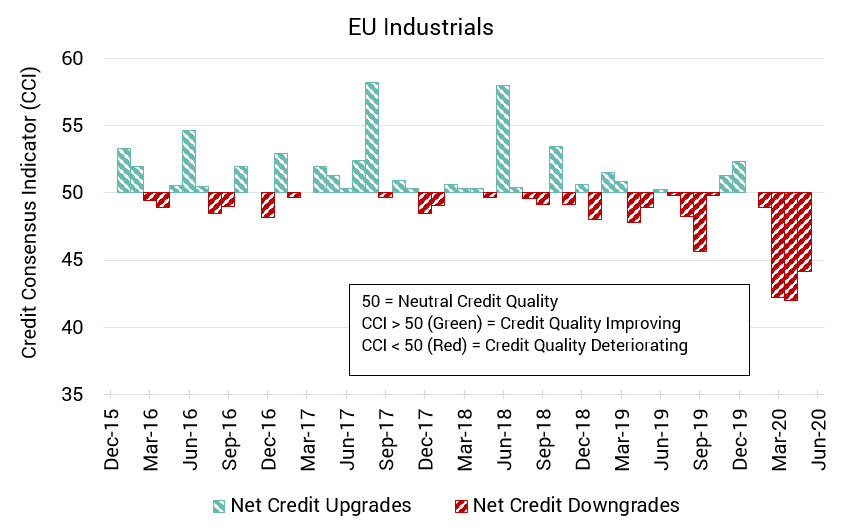

EU Industrials: Credit Downgrades Persist for Sector

EU Industrial companies continue a pattern of net credit downgrades which has persisted for 4 months.

The CCI for this month is 44.2; a slight improvement from last month’s CCI of 41.9 but still firmly in the red.

PMI figures from last month indicate that Eurozone manufacturing is recovering as EU nations move out of lockdown. However, export figures remain well below pre-virus levels as COVID-19 continues to stymie international trade.

.

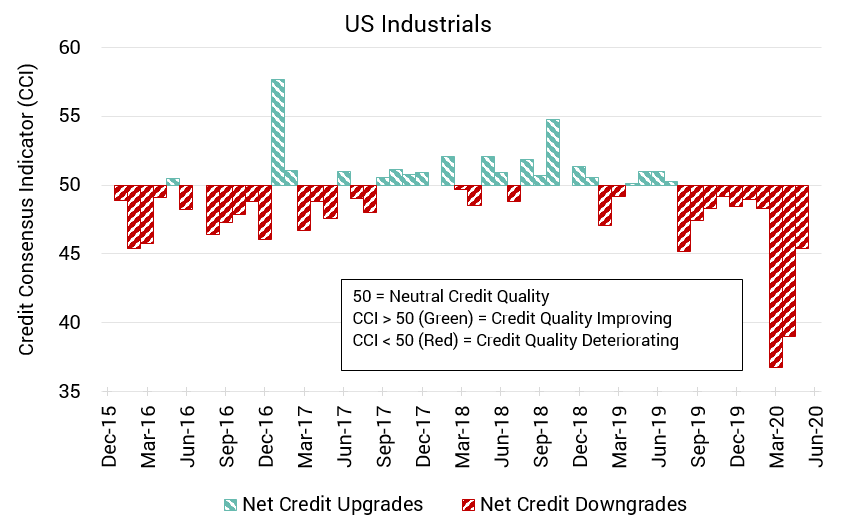

US Industrials: CCI Remains Negative But Severity Eases

This month saw fewer downgrades for US Industrial companies than the previous two months but the balance still hangs in the negative.

The CCI for this month is 45.4; something of a reprieve from last month’s CCI of 38.9.

This is the tenth consecutive month of net downgrades for the sector. Though production levels are growing, with an increase of 7.2% last month, factory output in the US is still 11.1% lower than in February.

.

To download the full CCI tear sheets for UK, EU, and US Industrials, please enter your details below: