Credit Benchmark have released the end-month industry update for end-September, based on the final and complete set of the contributed credit risk estimates from 40+ global financial institutions.

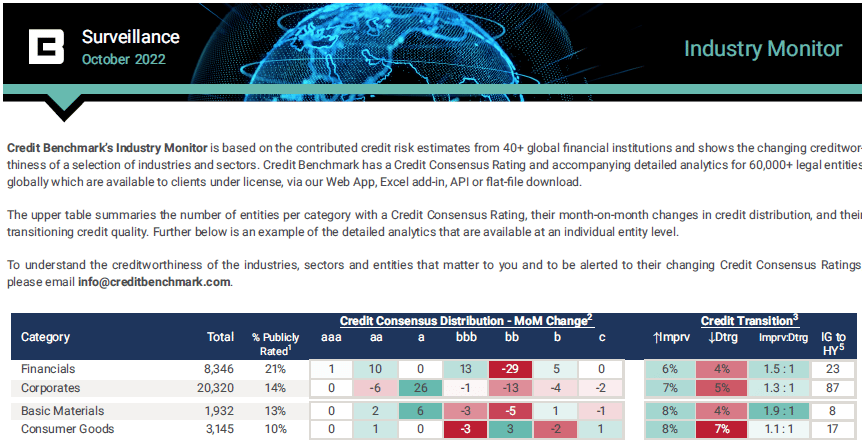

Upgrades and downgrades have again stayed relatively balanced this month, though the modest bias towards improvement continues. Financials showed slightly superior credit traction than Corporates, with a ratio of 1.5:1 improvements to deteriorations. Corporates came in at a ratio of 1.3:1.

Of the industries, Oil & Gas maintains dominance as a top performer, at a ratio of 2.7:1 improvements to deteriorations. Next strongest were Basic Materials, at 1.9:1, followed by Consumer Services at 1.6:1. The rest of the industries were close to neutral, with Utilities coming in last with a negative ratio of 1:1.3 improvements to deteriorations.

Of the sectors, Oil & Gas unsurprisingly were the strongest – Canada Oil & Gas led the pack at 16:1 improvements to deteriorations, followed by US firms at 4.8:1 and UK at 1.9:1. Travel & Leisure companies also performed well, with 2.5 improvements to every deterioration. There were no instances of net deterioration, but Construction & Material firms were weakest overall, at 1.1:1.

In the update, you will find:

Credit Benchmark will continue to provide regular reports on these migration rates. If you have any questions about the contents of this update, please get in touch.