Credit Benchmark have released the end-month industry update for end-June, based on the final and complete set of the contributed credit risk estimates from 40+ global financial institutions.

The latest consensus data provide even more reason for optimism, with widespread improvement in credit risk.

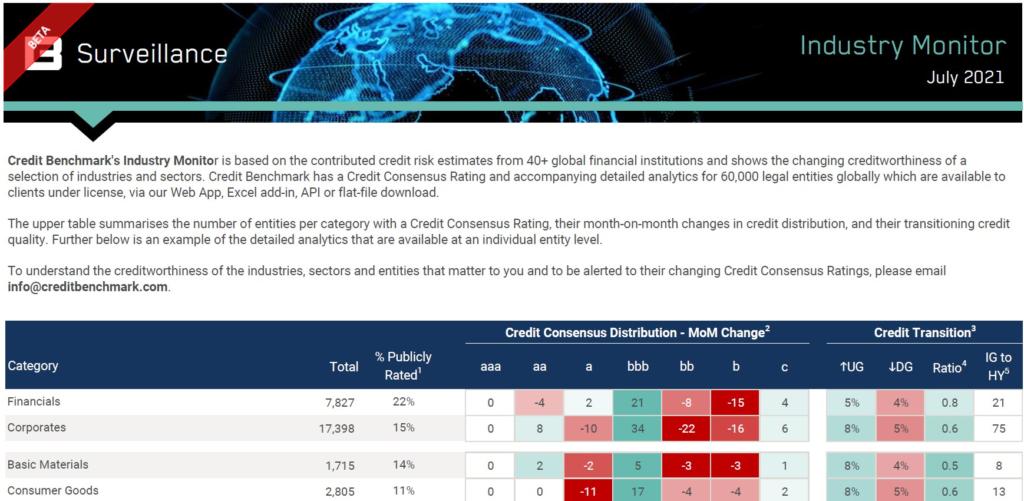

The broad category of Corporates once again saw a dominance of upgrades, with an overall deterioration-to-improvement ratio of 0.6:1. This improvement translated to individual categories, like Consumer Goods and Consumer Services which had ratios of 0.6:1 and 0.7:1, respectively. Health Care and Industrials performed equally well, with ratios of 0.7:1 and 0.6:1. Even beleaguered Oil & Gas firms saw an overall credit improvement this month.

Unfortunately, Travel & Leisure firms remain languishing in net deterioration, but to a less severe extent than previous months, with a ratio of 1.4:1. Utilities saw the highest rate of deterioration this month, at 1.5:1.

Perhaps most notable is the improvement seen in Financials, which has jumped from a deteriorating ratio of 1.7:1, to an improving ratio of 0.8:1

According to David Carruthers, Head of Research at Credit Benchmark:

“The upgrades seen across financial firms is a positive development, as this category has seen a dominance of deterioration in recent months. The sector faces obstacles ahead, like loan quality and stunted economic growth in the face of a fresh increase in Covid cases, but at the moment, credit for financial companies isn’t getting worse. A strong financial sector from a credit perspective is to the benefit of the overall economy.”

In the update, you will find:

Credit Benchmark will continue to provide regular reports on these migration rates. If you have any questions about the contents of this update, please get in touch.