Credit Benchmark have released the end-month industry update for end-January, based on the final and complete set of the contributed credit risk estimates from 40+ global financial institutions.

Corporate credit quality continues to improve, as does that of Financials. In this month’s credit consensus update, almost all industries and sectors showed a dominance of improvement over deterioration.

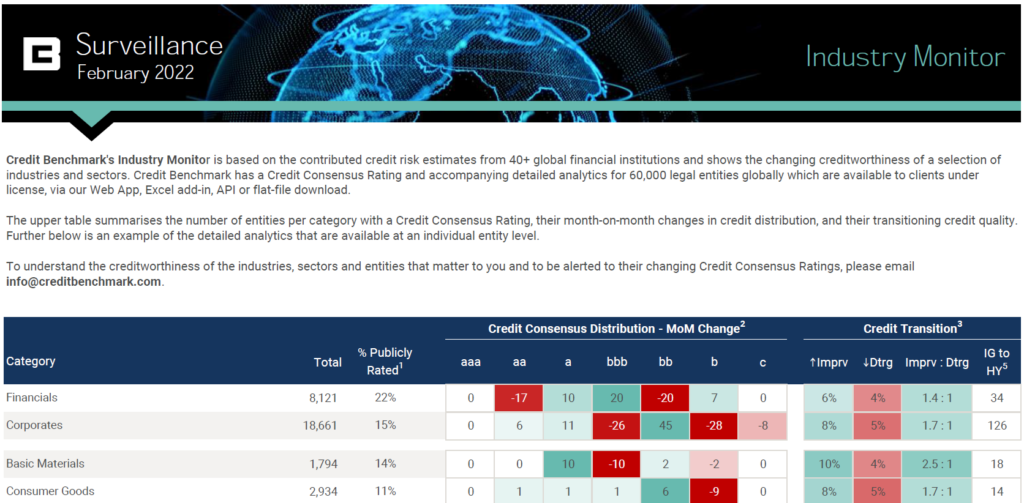

Corporates performed slightly better than Financials, with an improvements to deteriorations ratio of 1.7:1, while Financials still remained in the green with a ratio of 1.4:1.

Out of the industries, the stand out this month was Basic Materials, with a ratio of 2.5 improvements to every deterioration. Consumer Goods and Consumer Services were level, both with a ratio of 1.7:1, as well as Health Care. Technology remained neutral with a ratio of 1:1. The only instance of net deterioration was in Utilities – only barely tipping the balance into the red.

Amid the sectors, the Canadians came out on top, dominating in both overall Corporates with an improving to deteriorating ratio of 3.2:1, but also notably in Oil & Gas, at 4.7:1, likely due to new pipeline connections and expansions in the US Gulf. US and UK Oil & Gas also performed well. There were no instances of net deterioration among the sectors this month, though UK Corporates were comparatively the weakest performer, still with a positive ratio of 1.3:1.

In the update, you will find:

Credit Benchmark will continue to provide regular reports on these migration rates. If you have any questions about the contents of this update, please get in touch.