Credit Benchmark have released the end-month industry update for end-July, based on the final and complete set of the contributed credit risk estimates from 40+ global financial institutions.

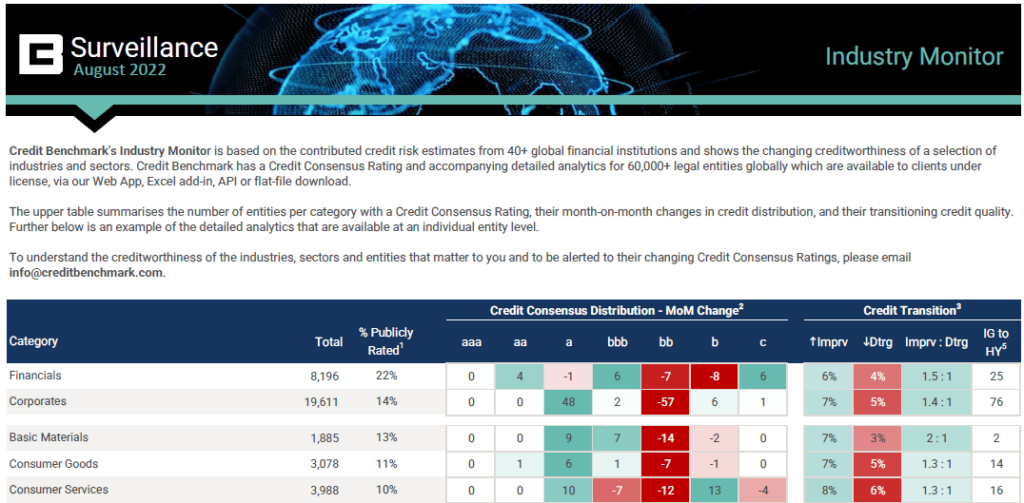

Global Financials and Global Corporates both enjoyed a predominance of credit improvements this month; setting the tone for the broader industry update. Financials showed a ratio of improvements to deteriorations of 1.5:1, with Corporates slightly behind with a ratio of 1.4:1.

Of the industries, Oil & Gas firms were the top performers, with 2.4 improvements to every deterioration. Close behind were Basic Materials firms, with a ratio of 2:1. Industrials were the next most positive group, with a ratio of 1.4:1 improvements to deteriorations. The only industry that demonstrated net negative credit quality was Telecommunications, with a modestly negative ratio of 1:1.1.

The sector breakdown demonstrates that US Oil & Gas firms were responsible for the strong credit showing for the broader industry – the ratio this month for this group of firms is 3.5:1 improvements to deteriorations. Conversely, UK Oil & Gas firms dragged the average down somewhat, with a negative ratio of 1:1.2. All other sectors showed positive credit ratios this month, with Canadian Corporates and US Corporates also showing strong improving trends, with ratios of 3:1 and 1.5:1 respectively.

In the update, you will find:

Credit Benchmark will continue to provide regular reports on these migration rates. If you have any questions about the contents of this update, please get in touch.