Credit Benchmark have released the end-month industry update for end-July, based on the final and complete set of the contributed credit risk estimates from 40+ global financial institutions.

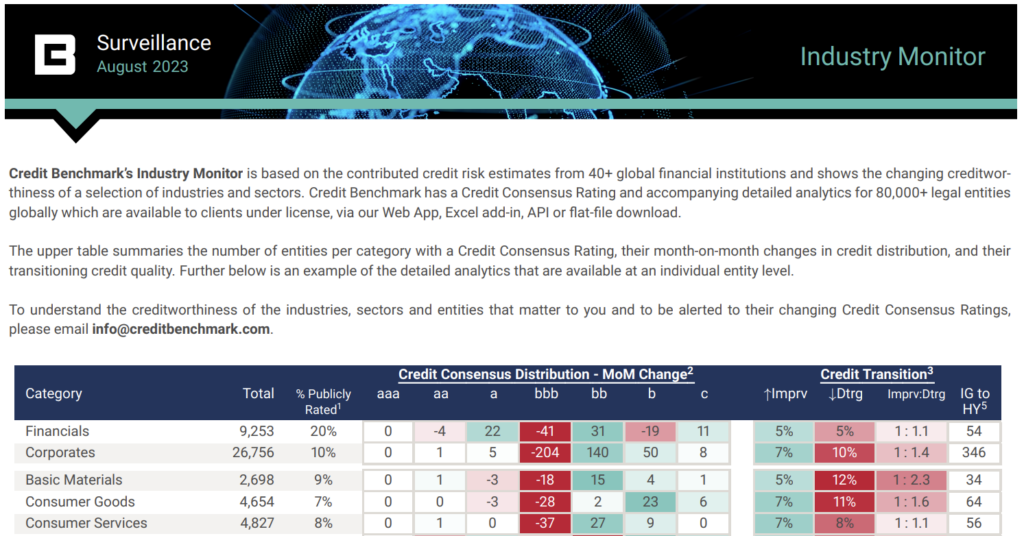

Both Financials and Corporates credit quality show a bias towards net credit deterioration this month, with negative ratios of 1.1 and 1.4 deteriorations to each improvement respectively.

Oil & Gas is the only industry showing a bias towards improvement, with a positive ratio of 1.1 improvements to each deterioration. Basic Materials stands out with a negative ratio of 2.3 deteriorations to each improvement, followed by Utilities with an improving to deteriorating ratio of 1:1.7.

Oil & Gas strength is also reflected at the sector level, with US and Canada firms showing positive ratios. Travel & Leisure companies continue to perform well, with 1.9 improvements to every deterioration. Construction & Materials stand out with a bias towards credit deterioration, with an improving to deteriorating ratio of 1:1.4.

Credit Benchmark will continue to provide regular reports on these migration rates. If you have any questions about the contents of this update, please get in touch.