The lack of easily accessible, reliable credit rating information on the vast majority of Funds leads to missed commercial opportunities and frustrating backlogs in onboarding, Know Your Customer (KYC), Agency Lending Disclosure (ALD) and Operational Due Diligence (ODD) processes. Credit Benchmark Credit Consensus Ratings fill this important gap for firms looking to do more business with the Buy-Side.

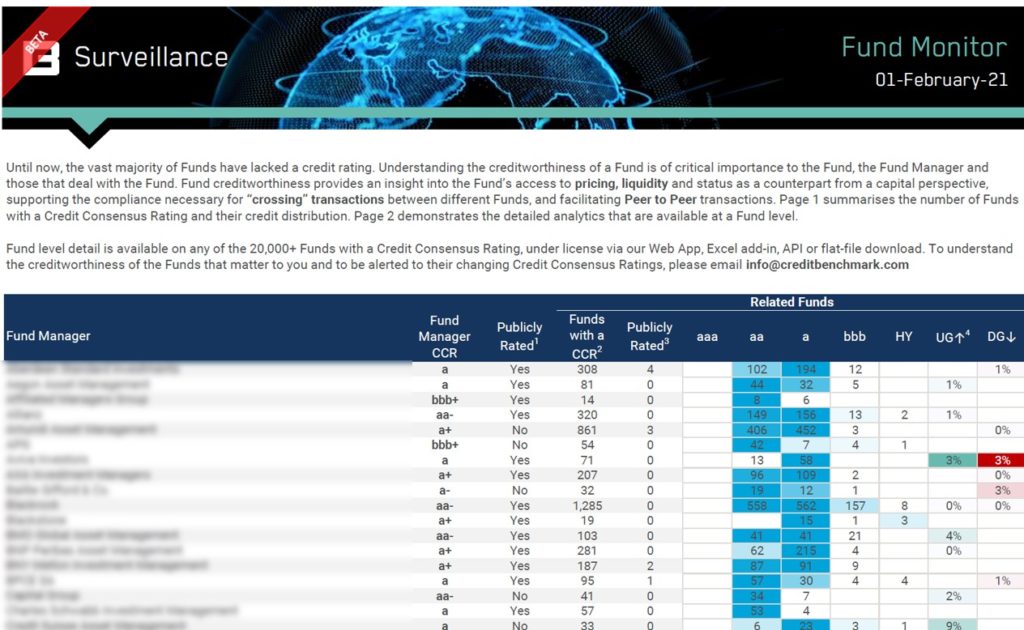

The new Fund Monitor from Credit Benchmark shows the growing number of Credit Consensus Ratings available today for the Funds managed by the top 70 global Fund Managers. Less than 1% of these Funds have a traditional public credit rating, despite their relatively high Credit Consensus Ratings. The high Credit Consensus Ratings would mark them out as high priority, attractive counterparts with potentially low RWA.

The Fund Monitor also demonstrates detailed analytics available at a Fund level for any of the 20,000+ Funds with a Credit Consensus Rating, under license via the Credit Benchmark Web App, Excel add-in, API or flat-file download.

Understanding the creditworthiness of a Fund is of critical importance to the Sell Side, the Fund Manager, investors in the Fund, as well as those responsible for the Fund itself. You can now access exclusive Credit Consensus Rating information and analytics on over 20,000 Funds, providing insight into pricing, liquidity and status as a counterpart from a capital perspective. This valuable data also supports the compliance necessary for “crossing” transactions between different Funds, and facilitating Peer to Peer transactions.