The Financial Counterpart Monitor from Credit Benchmark provides a unique analysis of the changing creditworthiness of financial institutions.

It has been another negative month for the credit quality of Global Financial Counterparts, with few exceptions.

Amongst the Banks, only APAC Banks came in at neutral, with the rest biased towards credit deterioration this month. North American Banks and Latin American Banks stand out with the strongest bias towards credit deterioration, with improving to deteriorating ratios of 1:2.3 and 1:2 respectively.

Intermediaries performed a little better. Broker Dealers came out on top with an improving to deteriorating ratio of 1.3:1. Prime Brokers were the most in the red with a ratio of 2 deteriorations to every improvement.

Amongst the Buy Side, Asset Managers and Mutual Funds showed a bias towards credit deterioration, both with improving to deteriorating ratio of 1:1.6. The only example of positive movement was seen in Insurance Companies, with an improving to deteriorating ratio of 1.2:1.

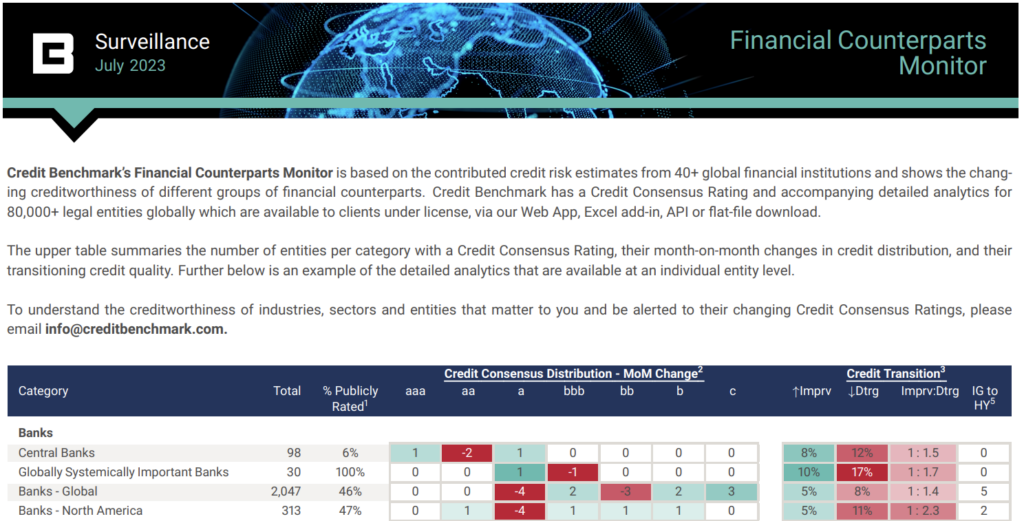

The Financial Counterpart Monitor from Credit Benchmark provides a unique analysis of the changing creditworthiness of financial institutions. The report, which covers banks, intermediaries, buy-side managers, and buy-side owners, summarizes the changes in credit consensus of each group as well as their current credit distribution and count of entities that have migrated from Investment Grade to High Yield.

The data, which is based on the credit risk views of Credit Benchmark’s contributing financial institutions, is also available at the legal entity level. Users of the data can monitor and be alerted to the changing credit consensus of their financial counterparts.